Black Knight: First Look August Delinquency Numbers Positive

(Image Courtesy Black Knight)

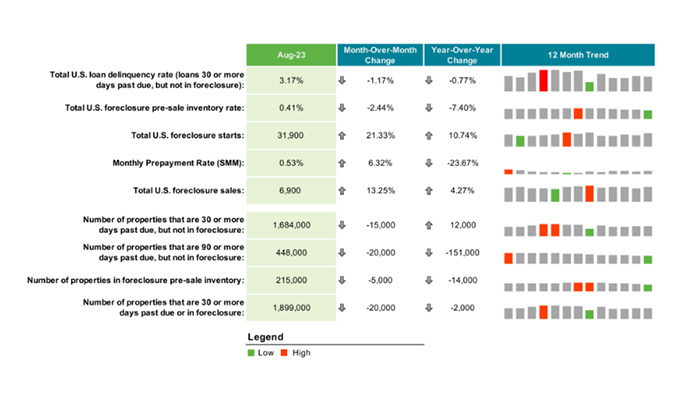

Black Knight, Jacksonville, Fla., released its First Look at its August Mortgage Monitor, finding that the delinquency rate improved yet again, but gains are slowing. That, Black Knight said, might suggest delinquency rates are reaching cycle lows.

The U.S. delinquency rate hit 3.17% in August, a 4-basis point improvement, and nearly a percentage point below the 2015-2019 average for the month.

Serious delinquencies also improved, down 20,000 from July to 448,000. That’s the lowest level since June 2006, and down 25% year-over-year.

Early-stage delinquencies are beginning to creep up–both the 30- and 60-day late categories saw a third straight monthly increase.

The number of loans in active foreclosure were at 215,000, down 68,000 from pre-pandemic February 2020. August had 31,900 foreclosure starts, well below pre-pandemic levels.

There was a slight increase in foreclosure sales from July to August–at 6,900–still roughly half of pre-pandemic levels.

Prepayment activity was also slightly up, to 0.53%.