MBA: 1Q Mortgage Delinquency Rates Near Historic Lows

Mortgage delinquency rates fell to near-historic lows in the first quarter, the Mortgage Bankers Association reported Thursday.

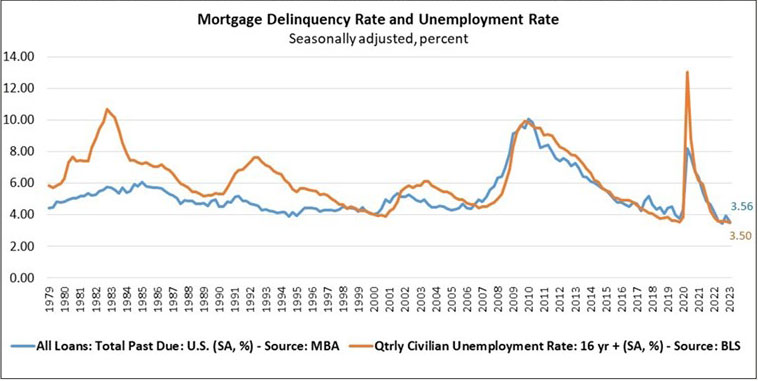

The MBA National Delinquency Survey said the delinquency rate for mortgage loans on one-to-four-unit residential properties fell to a seasonally adjusted rate of 3.56 percent of all loans outstanding at the end of the first quarter, down 40 basis points from the fourth quarter and down 55 basis points from a year ago.

The percentage of loans on which foreclosure actions started in the first quarter rose by 2 basis points to 0.16 percent.

“The mortgage delinquency rate fell to its lowest level for any first quarter since MBA’s survey began in 1979 and was the second- lowest quarterly rate overall, just 11 basis points above the survey low in the third quarter of 2022,” said Marina Walsh, CMB, MBA Vice President of Industry Analysis. “Mortgage delinquencies and the unemployment rate continue to track each other closely, with the unemployment rate in April falling back to the 54-year low of 3.4 percent set in January.”

Walsh said consistent with the resilient job market, “the performance of existing mortgages is exceeding expectations. Across all states, there was an improvement in the first quarter compared to one year ago. Year-over-year delinquencies for all product types – FHA, VA and conventional – were also down.”

The MBA forecast calls for an economic slowdown and an increase in unemployment later this year and into next year. Looking forward, Walsh noted that the end of COVID-19 forbearance programs means some distressed borrowers may be offered different forbearance and loss mitigation options than those given during the pandemic.

Key Findings of the MBA 1st Quarter National Delinquency Survey:

–The seasonally adjusted mortgage delinquency rate decreased for all loans outstanding from the fourth quarter. By stage, the 30-day delinquency rate decreased by 15 basis points to 1.77 percent; the 60-day delinquency rate decreased by 11 basis points to 0.55 percent; and the 90-day delinquency bucket decreased by 14 basis points to 1.24 percent.

–By loan type, the delinquency rate for conventional loans decreased by 34 basis points to 2.44 percent from the fourth quarter. The FHA delinquency rate decreased by 134 basis points to 9.27 percent, while the VA delinquency rate decreased by 18 basis points to 3.98 percent.

–Year-over-year, mortgage delinquencies decreased for all loans outstanding. The delinquency rate decreased by 59 basis points for conventional loans, by 31 basis points for FHA loans and by 88 basis points for VA loans.

–The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the first quarter was unchanged at 0.57 percent from the fourth quarter of 2022 and 4 basis points higher than a year ago.

–The non-seasonally adjusted seriously delinquent rate (the percentage of loans that are 90 days or more past due or in the process of foreclosure) fell to 1.73 percent, down by 16 basis points from fourth quarter and by 66 basis points from a year ago. The seriously delinquent rate decreased by 11 basis points for conventional loans, by 39 basis points for FHA loans and by 17 basis points for VA loans. From a year ago, the seriously delinquent rate decreased by 53 basis points for conventional loans, by 132 basis points for FHA loans and by 89 basis points for VA loans.

–States with the largest quarterly decreases in their overall delinquency rate were Arkansas (117 basis points), Louisiana (114 basis points), West Virginia (111 basis points), Indiana (103 basis points) and Oklahoma (96 basis points).

For the purposes of the survey, MBA asks servicers to report loans in forbearance as delinquent if the payment was not made based on the original terms of the mortgage.