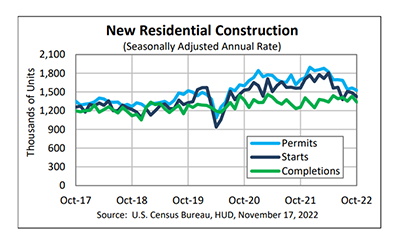

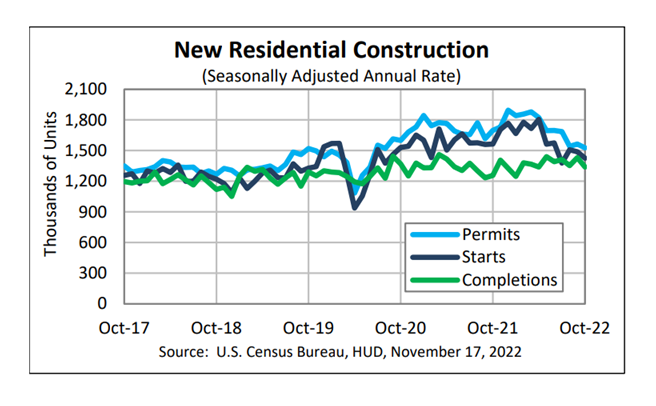

October Housing Starts Down 4.2%

Housing starts fell in October—the third straight monthly decline—but generally beat analysts’ expectations, HUD and the Census Bureau reported Thursday.

The report said privately owned housing starts in October fell to a seasonally adjusted annual rate of 1,425,000, 4.2 percent below the revised September estimate of 1,488,000 and 8.8 percent lower than a year ago (1,563,000). Single‐family housing starts in October fell to 855,000, 6.1 percent lower than the revised September figure of 911,000. The October rate for units in buildings with five units or more fell to 556,000, down by 0.5 percent from September but up by 17.3 percent from a year ago.

Regionally, starts rose in the South, increasing by 6.7 percent in October to 808,000 units, seasonally annually adjusted, from 757,000 units in September. From a year ago, starts in the South fell by 1.1 percent.

In the West, starts fell by 10.6 percent in October to 336,000 units, seasonally annually adjusted, from 376,000 units in September and fell by nearly 20 percent from a year ago. In the Midwest, starts fell by 11.1 percent in October to 185,000 units from 208,000 units in September and fell by 13.6 percent from a year ago. In the Northeast, starts fell by 34.7 percent in October to 96,000 units from 147,000 units in September and fell by nearly 16 percent from a year ago.

“Housing starts come in above consensus expectations,” said Odeta Kushi, Deputy Chief Economist with First American Financial Corp., Santa Ana, Calif. “As builders pull back on starting new projects, they will have greater opportunity to bring to market the large backlog of homes in their pipelines that are already under construction. The number of single-family homes under construction remains elevated due to construction delays brought on by labor and material shortages.”

Kushi noted costs for construction materials and labor remain significantly elevated, though material costs have shown some signs of easing. “Affordability is also a concern, as rates remain significantly elevated compared with one year ago,” she said. “The elevated price of labor and materials are passed on to the consumer in the form of higher new-home prices during a time when affordability is down, presenting a challenge for builders who are trying to attract potential home buyers by cutting prices and offering incentives, but are limited by these high material and labor costs. The median sale price for new homes remains near an all-time high.”

Kushi also noted while single-family homebuilding continues to slow as builders respond to the strong pullback in purchase demand and ongoing supply-side headwinds, the October report confirms that multi-family remains strong. “More multi-family supply may ultimately put some downward pressure on rents,” she said.

Overall, the housing correction continues with little indication that a bottom is in sight,” said Charlie Dougherty, Economist with Wells Fargo Economics, Charlotte, N.C. “Souring builder sentiment is another indication that a return to favorable market conditions is still a long ways away.”

“Although September’s figure was revised upward modestly, the general trend of single-family starts continues to be downward,” said Doug Duncan, Chief Economist with Fannie Mae, Washington, D.C. “Moving forward, we expect new home construction to continue to soften as the effects of rising mortgage rates continue to weaken homebuying demand.”

The report said privately owned housing units authorized by building permits in October fell to a seasonally adjusted annual rate of 1,526,000, 2.4 percent below the revised September rate of 1,564,000 and is 10.1 percent lower than a year ago (1,698,000). Single‐family authorizations in October fell to 839,000, 3.6 percent below the revised September figure of 870,000. Authorizations of units in buildings with five units or more fell to 633,000 in October, down by 1.9 percent from September but up by 11.2 percent from a year ago.

Privately owned housing completions in October fell to a seasonally adjusted annual rate of 1,339,000, 6.4 percent below the revised September estimate of 1,431,000, but 6.6 percent higher than a year ago (1,256,000). Single‐family housing completions in October fell to 961,000, 8.3 percent below the revised September rate of 1,048,000. The October rate for units in buildings with five units or more fell to 362,000, down by 5 percent from September but up by 18.3 percent from a year ago.