July Housing Starts Take Sharp Hit

It already hasn’t been a good week for housing. On Monday, the National Association of Home Builders reported its Housing Market Index fell for the eighth straight month to two-year low. And on Tuesday, HUD and the Census Bureau reported housing starts fell in July by nearly double digits to its slowest pace since 2020.

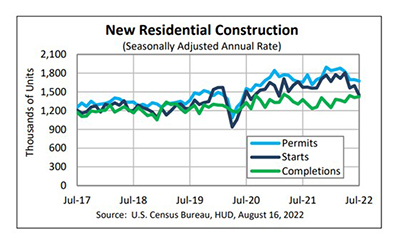

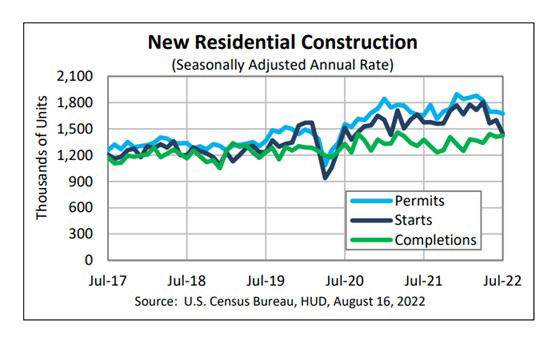

HUD/Census said privately owned housing starts in July fell to a seasonally adjusted annual rate of 1,446,000, 9.6 percent below the revised June estimate of 1,599,000 and 8.1 percent lower than a year ago (1,573,000). Single‐family housing starts in July fell to 916,000; 10.1 percent below the revised June figure of 1,019,000 to its lowest rate since 2020. The July rate for units in buildings with five units or more fell to 514,000, down by 10 percent from June (571,000) but up by 17.4 percent from a year ago.

Regionally, results were mixed. In the largest region, the South, starts fell by nearly 18 percent in July to 710,000 units, seasonally annually adjusted, from 873,000 units June and fell by 21.5 percent from a year ago. In the West, starts fell by 2.7 percent in July to 367,000 units from 377,000 units in June and fell by nearly 12 percent from a year ago.

In the Midwest, starts plunged by nearly 34 percent in July to 139,000 units, seasonally annually adjusted, from 210,000 units in June and fell by nearly 24 percent from the year ago. Only the Northeast saw improvement; starts there jumped by 65.6 percent in July to 230,000 units from 139,000 units in June and improved by a whopping 228.6 percent from a year ago.

“Housing starts were expected to fall to an annual pace of 1.52 million in July, but instead fell further, coming in at 1.45 million,” said Odeta Kushi, Deputy Chief Economist with First American Financial Corp., Santat Ana, Calif. “The decrease in single-family housing starts mirrors the decline in homebuilder confidence, which turned negative in August.”

Kushi noted builders are responding to a pullback in demand, “as rising mortgage rates have dampened affordability and caused would-be buyers to sit on the sidelines.”

“Single-family starts have now declined on a sequential basis for five consecutive months,” said Mark Vitner, Senior Economist with Wells Fargo Economics, Charlotte, N.C. “The pull-back is primarily owed to higher mortgage rates, which have significantly worsened affordability and caused buyers to head to the sidelines.”

Vitner said judging by continued weakness in building permits, starts likely have further to fall, a sentiment echoed by Doug Duncan, Chief Economist with Fannie Mae, Washington, D.C.

“We expect new home construction will continue to decline through the rest of the year amid the higher mortgage rate environment and significantly lower home builder confidence,” Duncan said.

The report said privately owned housing units authorized by building permits in July fell to a seasonally adjusted annual rate of 1,674,000, 1.3 percent below the revised June rate of 1,696,000, but 1.1 percent higher than year ago. Single‐family authorizations in July fell to 928,000; this is 4.3 percent below the revised June figure of 970,000. Authorizations of units in buildings with five units or more fell to 693,000, 2.5 percent higher than in June (676,000) and 26.2 percent higher than a year ago.

HUD/Census said privately owned housing completions in July rose to a seasonally adjusted annual rate of 1,424,000, 1.1 percent higher than the revised June estimate of 1,409,000 and 3.5 percent higher than a year ago. Single‐family housing completions in July fell to 1,009,000; 0.8 percent below the revised June rate of 1,017,000. The July rate for units in buildings with five units or more rose to 412,000, up by 6.7 percent from June but down by nearly 2 percent from a year ago.

On Thursday, the National Association of Realtors releases its Existing Home Sales report for July. Next Monday, Aug. 22, the Mortgage Bankers Association releases its monthly Builder Applications Survey; on Tuesday, Aug. 24, HUD/Census releases its monthly New Residential Sales report for July; and on Wednesday, Aug. 25, NAR releases its Pending Home Sales Index. MBA NewsLink will provide coverage of each report.