CoreLogic: Home Prices Rise at Fastest Pace Since 2006

CoreLogic, Irvine, Calif., said sparse inventory and high demand placed upward pressure on home prices, leading to a third straight month of double-digit percentage growth.

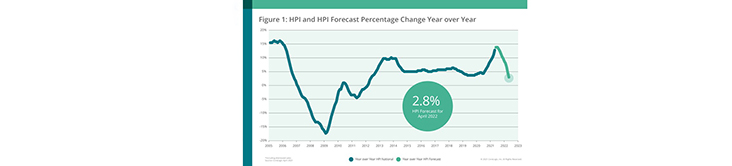

The company’s monthly Home Price Index and HPI Forecast reported home prices rose by 13 percent on annual basis in April, the highest rate of appreciation since February 2006. On a month-over-month basis, home prices increased by 2.1% from March. Appreciation of detached properties (14.7%) was more than double that of attached properties (7.2%) in April as prospective buyers continue to seek out more space.

CoreLogic Chief Economist Frank Nothaft said limited inventories are discouraging potential sellers, further exacerbating inventory and affordability challenges creating challenges across generations as buyer preferences shift.

“Baby boomers are staying in their homes longer, slowing the pace with which existing homes come on the for-sale market,” Nothaft said. “Owner occupants today have been in their homes for a median of 13 years, about 50% longer than the previous generation.”

The report also noted younger millennials continue to enter the market in droves while older millennials look to upgrade and upsize their homes. In a recent CoreLogic consumer survey, the need for more space was noted as the top driver (64%) for demand among these cohorts.

The report said increased competition among buyers could cause a ripple effect and create affordability challenges for baby boomers interested in downsizing or relocating. Notably, 72% of this cohort list the desire for a new location as the main reason for wanting to purchase a new home. However, in response to rising prices, baby boomers — who own 54% of the nation’s homes — may wait to sell, creating further inventory pressures for older millennials seeking move up-purchases.

“As older homeowners become more comfortable with listing their homes, they are faced with the reality that if they sell, they may get a smaller home for the same price as what they already have,” said Frank Martell, president and CEO of CoreLogic. “Rather than decreasing their financial burden and cashing out equity to support their retirement, baby boomers may choose to stay put — which could exacerbate inventory challenges.”

The report said home prices are projected to increase 2.8% by April 2022, as affordability and supply challenges drive potential buyers out of the market, causing a slowdown in home price growth.

In April, home prices rose sharply in the west with Coeur d’Alene, Idaho, experiencing the highest year-over-year increase at 31.4%. Boise City, Idaho, ranked second with a year-over-year increase of 28.6%. At the state level, Idaho and Arizona continued to have the strongest price growth at 27.2% and 20.4%, respectively. South Dakota also had a 19.3% year-over-year increase as new home buyers seek out more affordable options, space and low property taxes.