The beginning of the calendar year brings changes to employee benefits and associated costs for both mortgage company employers and employees. Based on data collected through the MBA and STRATMOR Peer Group Roundtables Program, this week’s Chart of the Week shows that residential lender-paid and servicer-paid costs have generally increased over the past five years, from 2020 to the first half of 2025, at a faster pace than the previous five years, from 2015 to 2020.

Tag: Servicing

Mortgage Servicing Apps Deliver Uneven User Experience, J.D. Power Finds

The mortgage servicing industry lags behind other sectors when it comes to streamlined, easy-to-navigate interfaces and convenient access, according to J.D. Power, Troy, Mich.

Q&A With Cornerstone Servicing’s Toby Wells: How AI Is Transforming Mortgage Servicing

Cornerstone Servicing’s Toby Wells sat down with MBA NewsLink to talk about the effects of AI on servicing.

Autoagent’s Steven Pals: Navigating CFPB Uncertainty, Compliance, Cost Pressures for Servicers

Rising loan servicing costs, tightening profit margins and persistent questions around regulatory oversight–particularly as the Consumer Financial Protection Bureau continues to shift toward a hands-off approach in many areas–have created a landscape where servicers must be agile, lean and resilient.

Premier Member Editorial: It’s Time to Rethink Mortgage Servicing. Here’s Why.

STRATMOR Group Senior Partner Michael Grad says too many still treat mortgage servicing like a side business rather than a strategic asset. “That needs to change.”

Optimizing Mortgage Servicing: How Lenders Can Adapt to a Digital-First Landscape

The mortgage industry is undergoing a major transformation. Borrowers now expect the same convenience, speed and transparency from their mortgage servicer that they experience with their digital banking, retail and streaming experiences. At the same time, servicing mortgage loans presents increasing complexity. This situation compels lenders to navigate an evolving regulatory landscape while striving for operational efficiency.

The Hidden Risk Lurking Between Closing and Servicing Transfer

Blue Sage Solutions’ David Aach discusses a critical but often overlooked phase between the celebratory handshake and the loan’s transfer to a permanent servicer: interim servicing.

MBA Premier Member Editorial: The Compliance Gap Is Growing, and Servicers Can’t Afford to Fall In

During the height of the pandemic, federal regulators led the charge on borrower protections. Now that they are stepping aside, servicers are left navigating a fractured regulatory landscape with little federal guidance, Covius’ Jennifer Keys writes.

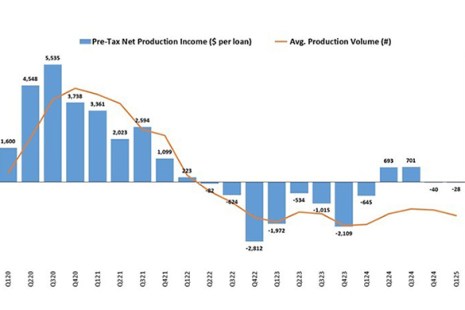

IMBs Report Slight Production Losses in First Quarter

Independent mortgage banks and mortgage subsidiaries of chartered banks reported a pre-tax net loss of $28 on each loan they originated in the first quarter, compared to a net loss of $40 per loan in the fourth quarter of 2024, according to MBA’s newly released Quarterly Mortgage Bankers Performance Report.

Call for Nominations: MBA NewsLink 2025 Tech All-Star Awards

The MBA NewsLink 2025 Tech All-Star Awards nomination period is underway. Nominations are due by Friday, June 6.