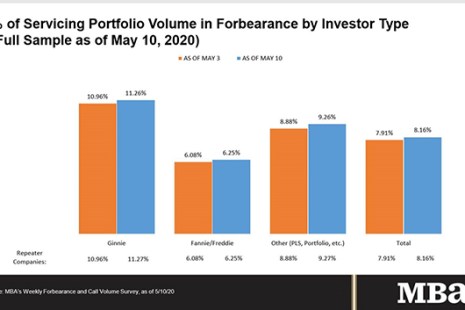

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey showed mortgage loans now in forbearance increased to 8.16% of servicers’ portfolio volume in as of May 10, up from 7.91% the previous week.

Tag: Mortgage Servicing

FHFA, GSEs Offer Payment Deferral as Repayment Option for COVID-19 Forbearance Plans

The Federal Housing Finance Agency on Wednesday said Fannie Mae and Freddie Mac will employ a new payment deferral option allowing borrowers in COVID-19 related forbearance, who are able to return to making their normal monthly mortgage payment, the ability to repay their missed payments at the time the home is sold, refinanced, or at maturity.

Paul Fischer of Paradatec on What Mortgage Servicers Can Expect in Months Ahead

Paul Fischer is Director of Professional Services with Paradatec, Cincinnati.

Survey: More than Half of Mortgage, Auto Borrowers Concerned About Making Upcoming Payments

Bankrate.com, New York, said more than half of mortgage and auto loan borrowers (54% of each) are concerned about their ability to make their payments over the next three months.

MISMO Launches Initiative to Apply Digital Mortgage Standards to Loan Modification Process

MISMO, the Mortgage Industry Standards Maintenance Organization, seeks industry participants to join its initiative of applying digital mortgage standards, guidelines and best practices to the loan modification process.

Andrew Foster: Case-By-Case–Commercial Mortgage Forbearance Consideration Begins

While the hope remains that the recession will be short-lived with a strong recovery in the second half of 2020, commercial real estate typically lags the broader economy. Any quick relief for the commercial mortgage industry will be due in part to government relief efforts. It will take patience from market participants before a clear picture of various outcomes emerges, in part because so much of the CRE finance market impacted by COVID-19 is entering into forbearance agreements.

House Democrats Add Pressure on Administration for Mortgage Servicing Liquidity

Twenty-seven House Democrats sent a letter last week to Administration officials urging them to take further steps to allow mortgage borrowers to avoid delinquency and to support mortgage servicers who are working with these borrowers.

FHFA: GSEs Will Purchase Qualified Loans in Forbearance

The Federal Housing Finance Agency said it would approve purchase of certain single-family mortgages in forbearance that meet specific eligibility criteria by Fannie Mae and Freddie Mac.

Groundswell of Support Builds for Federal Liquidity Facility

Pete Mills, MBA Senior Vice President of Residential Policy and Member Engagement, said the groundswell is sending a strong message to regulators.

Jennifer Henry: In an Uncertain Market, Servicers Are Leveraging Data, Technology to Drive Efficiency

While the falling home loan rates mean a booming business for the mortgage industry and a sign the housing market may help the U.S. economy avoid a true recession, it could also pose a challenge for those trying to process the influx of applications and requests. The digital mortgage servicing journey must focus on streamlining the process through technology and data-enabled solutions.