MBA NewsLink talked with Maurice Jourdain-Earl, Managing Director of ComplianceTech, McLean, Va., a provider of software and services to enable fair and responsible lending compliance. He is a noted speaker and writer on HMDA and fair lending practices and has appeared frequently at MBA events and sits on MBA’s member-led Diversity & Inclusion Advisory Committee.

Tag: Mortgage Servicing

Anita Bush: Offering Forbearance Under the CARES Act – A New Reality for Mortgage Servicers

While the number of new forbearance requests is declining, many servicers may still be working with forbearance borrowers for the rest of this year and into 2021. Here’s what servicers can do to handle this new reality.

CFPB Issues Interpretive Rule on Determining Underserved Areas; Final Rule on Loss Mitigation Options for Homeowners with COVID-Related Hardships

The Consumer Financial Protection Bureau issued an interpretive rule to provide guidance to creditors and other persons involved in the mortgage origination process about the way in which the Bureau determines which counties qualify as “underserved” for a given calendar year.

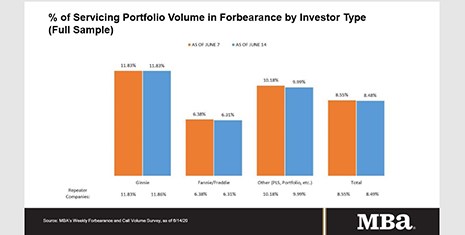

MBA: Share of Mortgage Loans in Forbearance Falls to 8.48%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey showed loans now in forbearance decreased – for the first time since the survey’s inception in March – from 8.55% of servicers’ portfolio volume in the prior week to 8.48% as of June 14.

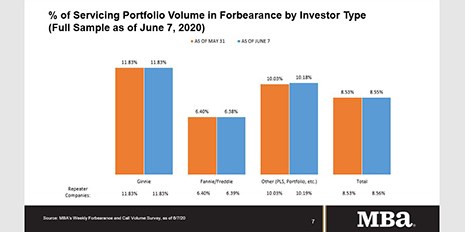

MBA: Share of Mortgage Loans in Forbearance Levels Out at 8.55%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey said loans now in forbearance increased just slightly, to 8.55% of servicers’ portfolio volume as of June 7 compared to 8.53% the prior week. MBA now estimates 4.3 million homeowners are in forbearance plans.

MBA, Trade Groups Oppose ‘Fundamentally Flawed’ California COVID Relief Bill

The Mortgage Bankers Association and nearly two dozen other industry trade groups sent a letter this week to California legislators, strongly opposing as “fundamentally flawed” and “disruptive” a broad-brush bill aimed at assisting state residents experiencing financial difficulties amid the coronavirus pandemic.

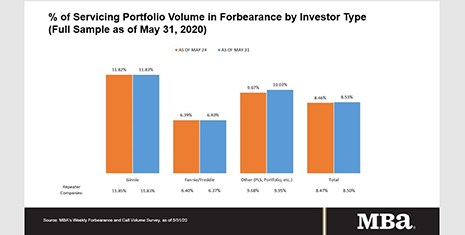

MBA Survey: Share of Mortgage Loans in Forbearance Slows to 8.53%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance increased to 8.53% of mortgage servicers’ portfolio volume as of May 31, compared to 8.46% the prior week.

Black Knight: 1 in 10 Homeowners in Forbearance Hold 10% or Less Equity in Their Homes

Black Knight, Jacksonville, Fla., said with its analysis of borrowers in forbearance showing forbearance volumes falling for the first time since the crisis began, industry participants – especially servicers and mortgage investors – must now shift from pipeline growth to pipeline management and downstream performance of loans in forbearance.

MBA Vice Chair Kristy Fercho Testifies Before House Subcommittee on Industry’s COVID-19 Response

Mortgage Bankers Association Vice Chair Kristy Fercho testified Friday before a House subcommittee on the real estate finance industry’s response to the coronavirus pandemic, saying mortgage servicers adapted to changing customer needs quickly and asking Congress to give the industry additional flexibility to address evolving market conditions.

John Walsh: Tax Service – A New Era

For decades, tax service has gone unchanged. There are many efforts to change this dynamic; layering in new technology for servicers to engage with their tax vendor and improving transparency in a historically monochromatic space.