The Consumer Financial Protection Bureau released two reports Tuesday, saying more work needs to be done to help mortgage borrowers coping with the COVID-19 pandemic and economic downturn.

Tag: Mortgage Servicing

MBA: 2020 IMB Production Volumes, Profits Hit Record-Highs

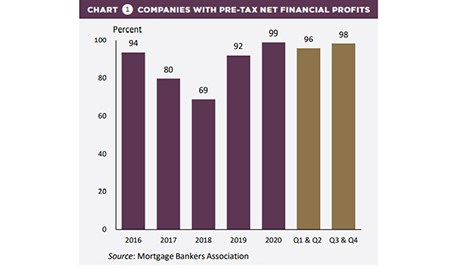

Independent mortgage banks and mortgage subsidiaries of chartered banks made an average profit of $4,202 on each loan they originated in 2020, up from $1,470 per loan in 2019, the Mortgage Bankers Association reported last week.

CFPB Proposes Mortgage Servicing Changes

The Consumer Financial Protection Bureau yesterday proposed a set of rule changes it said are intended to help prevent “avoidable foreclosures” as emergency federal foreclosure protections expire.

CFPB Issues Blunt Warning to Mortgage Servicers: ‘Unprepared is Unacceptable’

The Consumer Financial Protection Bureau last week warned mortgage servicers to “take all necessary steps now” to prevent a wave of avoidable foreclosures this fall.

Anita Bush: Effective Forbearance Management for Mortgage Loan Servicers

In this article, we’ll address some of the servicer’s legal requirements and offer three keys to success intended to help servicers manage the post-forbearance process.

Anita Bush: Effective Forbearance Management for Mortgage Loan Servicers

In this article, we’ll address some of the servicer’s legal requirements and offer three keys to success intended to help servicers manage the post-forbearance process.

Nick Volpe: Managing Effects of Changing Regulations on Mortgage Servicing Operations

As loan servicers continue to battle operational challenges and brace themselves for continuously high volume, there are strategies they should consider to better navigate the changing landscape.

Nick Volpe: Managing Effects of Changing Regulations on Mortgage Servicing Operations

As loan servicers continue to battle operational challenges and brace themselves for continuously high volume, there are strategies they should consider to better navigate the changing landscape.

Troubled Commercial Mortgage Loan Triage: A Special Servicer Roundtable

With the ebb and flow of 2020 market disruption in the rearview mirror and the vaccine rollout in full swing, MBA NewsLink checked in with two special servicers, a rating agency servicer analyst and Freddie Mac asset management chief to explore what is happening in commercial/multifamily markets, where different parts of the commercial real estate finance ecosystem are today and factors driving the outlook for agency and non-agency CMBS sectors.

MBA Education’s David Upbin on How MBA Education Can Help Lenders and Servicers in 2021

David Upbin is Vice President of Education Operations and Programming & MBA Strategy with the Mortgage Bankers Association. He joined MBA in 2013 and is responsible for financial management, operations, delivery and programming of MBA Education’s suite of training products and events.