The Federal Housing Finance Agency on Wednesday announced Fannie Mae and Freddie Mac will require servicers to obtain and maintain fair lending data on their loans, and for this data to transfer with servicing throughout the mortgage term.

Tag: Mortgage Servicing

Rhonda McGill of PerformLine: Mortgage Industry Compliance Concerns and Best Practices

PerformLine recently hosted a mortgage industry roundtable that gathered mortgage leaders to discuss best practices for ensuring compliance and consumer protection as we continue into a year of increased regulatory pressure.

MBA: IMB 4Q Production Profits Fall to 3-Year Low

Independent mortgage banks and mortgage subsidiaries of chartered banks reported a net gain of $1,099 on each loan they originated in the fourth quarter, its lowest level in three years, the Mortgage Bankers Association reported last Tuesday.

Sponsored Content from ACES Quality Management: Prep Your Audit Process for Fair Servicing

Given regulators’ renewed focus on fair lending and fair servicing, learn how to enhance your audit practices to meet regulatory expectations in 2022 and beyond.

Fitch: Non-Bank Mortgage Servicers Face Increasing Regulatory Scrutiny

Fitch Ratings, New York, said regulatory scrutiny of servicing practices at U.S. mortgage companies is expected to increase in 2022 as pandemic-related government forbearance programs expire and borrowers transition into other permanent loss mitigation alternatives or default.

Managing Fair Lending for IMBs

NASHVILLE, Tenn.—Independent mortgage banks know full well the importance of risk, whether it’s developing business strategies—or preparing for Fair Lending examinations.

CFPB, DOJ Issue Joint Letters on Servicemember/Veterans’ Rights

The Consumer Financial Protection Bureau and the Department of Justice on Monday issued two joint letters Monday on legal housing protections for military families.

MBA, Trade Groups Urge HUD to Issue ‘Clear Roadmap’ for Servicers in LIBOR Transition

As HUD considers changes to its index for FHA-insured adjustable-rate mortgages away from LIBOR, the Mortgage Bankers Association and other industry trade groups urged the Department to issue a clear roadmap for servicers of FHA-insured ARMs, including specification of a replacement comparable index or indices for existing mortgages, as well as guidance on communications with borrowers.

Arjun Raman of Wipro Opus Risk Solutions: Strapped for Time–Empower Overworked Staff with Outsourcing

The economic effects of the pandemic have placed strains on the day-to-day operations of servicers. An established relationship with a strategic outsourcing partner can streamline efficiency and productivity, resulting in improved scalability, increased cost savings and expertise at the ready.

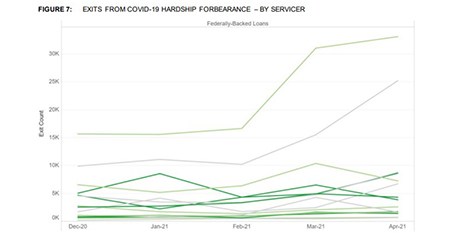

CFPB: Mortgage Servicers’ Pandemic Response Varies Significantly

The Consumer Financial Protection Bureau on Tuesday published a report detailing 16 large mortgage servicers’ COVID-19 pandemic response. The report showed a disparate response in call metrics, exit metrics and other measures.