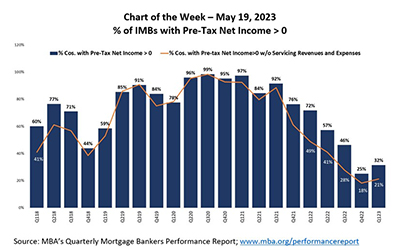

Today’s Chart of the Week compares the percentage of companies in the QPR that reported positive pre-tax net income including all lines of business (e.g. production and servicing operations), versus the percentage of companies that reported positive pre-tax net income, once servicing operations are excluded.

Tag: Mortgage Servicing

Elevating Your Quality Quotient, Part II: Mortgage Servicing Post-Pandemic

Regulations offer guardrails, but rebuilding trust is key to a vibrant mortgage servicing industry. The hurdles of the Great Financial Crisis have been largely overcome and the COVID-19 Pandemic National Emergency was formally decreed behind us on April 10. So, what does the marketplace for servicing look like today and what aspects of servicing could look different in the future?

#MBACMST23: How Servicers Stay Ahead of Challenges

CHICAGO–Commercial mortgage servicers must be able to adapt and pivot to face their daily challenges, servicing veterans noted at the MBA Commercial/Multifamily Finance Servicing and Technology Conference.

Bob Caruso of ServiceMac LLC: Servicing Strategies in a Heightened Compliance Environment

Over the past two decades, regulatory and investor guidelines have become much more nuanced. In addition, maintaining on-going compliance to the rules and audit guidelines has been challenging given servicers’ day-to-day responsibilities. Servicers have had to become more agile and look for ways to update processes and implement changes quickly to reduce the risk of non-compliance.

Souren Sarkar, CMB, of Nexval: What Recent Flight Fiascos Can Teach Us About Investing in Technology

If mortgage servicers ever needed an argument to not hold back on technology investments, they need look no further than the recent fiascos in the airline industry.

(#MBAServicing23) Market Outlook: A Few Hurdles Ahead

ORLANDO—The mortgage servicing industry has seen a lot of volatility lately—and that’s not likely to ease up any time soon, said Mortgage Bankers Association economists.

John Walsh of LERETA on Servicing Tax Issues

John Walsh is CEO of LERETA, Pomona, Calif. He leads an executive leadership team focused on providing the mortgage and insurance industries accuracy, responsiveness and innovative technology.

Souren Sarkar, CMB of Nexval on Business Process Outsourcing

Souren Sarkar, CMB, is president and co-founder of Nexval, a provider of technology-enabled mortgage services and fintech innovation for the financial services industry.

MBA Report: IMBs Report 3Q Losses

Independent mortgage banks and mortgage subsidiaries of chartered banks reported a net loss of $624 on each loan originated in the third quarter, the Mortgage Bankers Association reported Friday.

Bob Caruso of ServiceMac on Changes in Mortgage Servicing and Subservicing

Bob Caruso is CEO of ServiceMac LLC, Fort Mill, S.C., a wholly owned subsidiary of First American Financial Corp. The company’s website is https://info.firstamericanmortgagesolutions.com/about-servicemac.