Intercontinental Exchange, Atlanta, released its “first look” at September 2023 month-end mortgage performance data, finding the national delinquency rate rose to 3.29%.

Tag: Mortgage Delinquencies

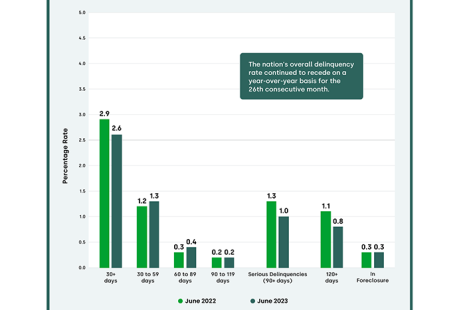

CoreLogic: No U.S. State Posts Annual Mortgage Delinquency Increases in June

U.S. mortgage performance remained exceptionally strong in June, with both overall delinquency and foreclosure rates at or near historic lows, reported CoreLogic, Irvine, Calif.

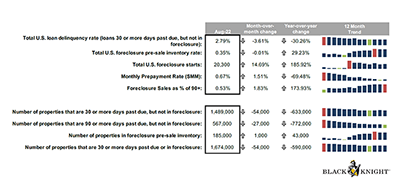

Black Knight: August Mortgage Delinquencies Near Record Low

Black Knight, Jacksonville, Fla., said mortgage delinquencies fell in August to near record lows, although foreclosure starts increased by 15 percent from July.

CoreLogic: 30 Years After Hurricane Andrew, Problems Persist for Insurance, Mortgage Industries

CoreLogic, Irvine, Calif., said in the 30 years since Hurricane Andrew devastated much of South Florida, the risk management landscape has evolved “tremendously.” But many questions remain—and with South Florida still a popular place to live, many of the risks from 1992 still exist today.

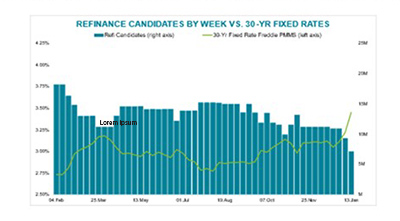

Black Knight: 1st Uptick in Early Stage Delinquencies in 9 Months

Black Knight, Jacksonville, Fla., said past-due loans increased by 1.8 percent in February, the first increase since last May.

Black Knight: Foreclosures at Record Low—But…

Black Knight, Jacksonville, Fla., reported just 0.24 percent of loans in active foreclosure in December, a record low, but cautioned that mortgage delinquency rates remain more than two times pre-pandemic levels.

Black Knight: Past-Due Loans Continue to Improve

Black Knight, Jacksonville, Fla., said the national delinquency rate rose to 4.73% from 4.66% in April, although the increase was driven largely by the three-day Memorial Day weekend foreshortening available payment windows.

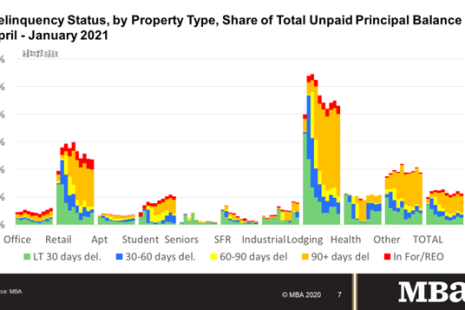

MBA: January Commercial, Multifamily Mortgage Delinquencies Decrease

Delinquency rates for mortgages backed by commercial and multifamily properties decreased in January, according to the Mortgage Bankers Association’s latest monthly MBA CREF Loan Performance Survey.

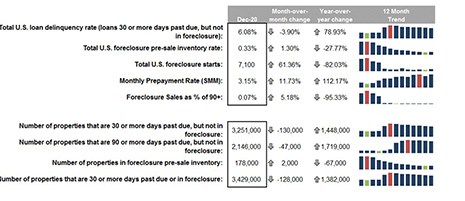

Black Knight First Look: 2020 Ends with Higher Delinquencies, Lower Foreclosures

Black Knight, Jacksonville, Fla., said 2020 ended with 1.54 million more delinquent and 1.7 million more seriously delinquent mortgages than at the start of the year, a looming reminder of the challenges facing the market in 2021.

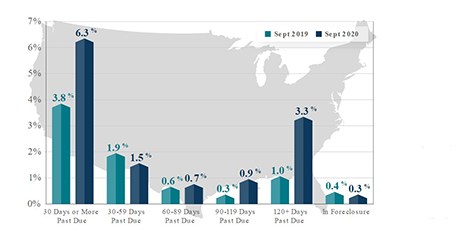

CoreLogic: Serious Delinquencies Level Off in ‘Positive Signal’

CoreLogic, Irvine, Calif., said its monthly Loan Performance Insights Report for September showed a leveling off of serious loan delinquencies, a “positive signal” that the housing finance industry is thus far adjusting to the pandemic-induced economic downturn.