Total nonfarm payroll employment increased by 139,000 in May, with the unemployment rate flat at 4.2%, the U.S. Bureau of Labor Statistics reported.

Tag: Mike Fratantoni

U.S. Adds 177,000 Jobs in April; Industry Economists Weigh In

The U.S. Bureau of Labor Statistics reported that 177,000 jobs were added to total nonfarm payroll employment last month, with the unemployment rate flat at 4.2%.

FOMC Rate Pause Remains; MBA Economist Weighs In

The Federal Reserve’s Federal Open Market Committee left interest rates unchanged on Wednesday.

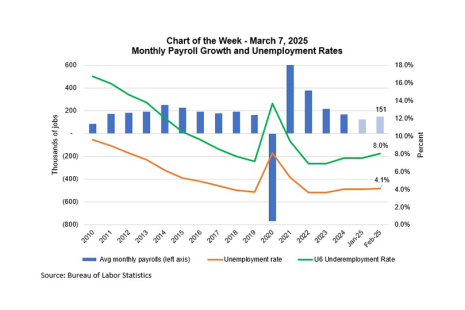

MBA Chart of the Week: Monthly Payroll Growth, Unemployment Rates

The job market softened somewhat in February, with the unemployment rate increasing to 4.1%, the pace of private sector job growth up by 140,000, and wage growth steady at 4%.

143,000 Jobs Added in January, Unemployment Rate Edges Down

There were 143,000 jobs added to total nonfarm payroll employment in January, the Bureau of Labor Statistics reported Feb. 7.

FOMC Holds Rates Steady; MBA Economist Weighs In

The Federal Reserve’s Federal Open Market Committee left interest rates unchanged Jan. 29.

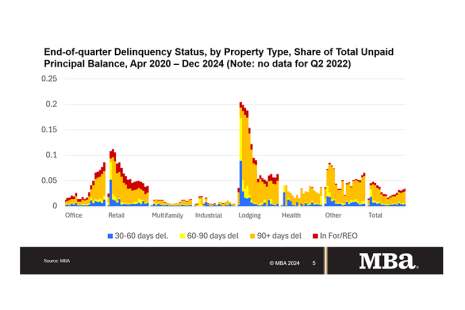

Delinquency Rates for Commercial Properties Increased in Fourth-Quarter 2024, MBA Finds

Delinquency rates for mortgages backed by commercial properties increased during the fourth quarter of 2024, according to the Mortgage Bankers Association’s latest commercial real estate finance (CREF) Loan Performance Survey.

Jobs Grow by More Than 250,000 in December; Industry Economists Weigh In

Total nonfarm payroll employment grew by 256,000 in December, and the unemployment rate was little changed at 4.1%, the U.S. Bureau of Labor Statistics reported.

FOMC Cuts Interest Rates; MBA Economist Weighs In

The Federal Reserve’s Federal Open Market Committee cut interest rates by 25 basis points Wednesday in its third consecutive reduction. The market had anticipated the change.

November Job Growth Exceeds Expectation

November’s job creation bounced back from October and exceeded consensus estimates.