This week, the Mortgage Bankers Association releases its 2nd Quarter National Delinquency Survey. Last week, ATTOM Data Solutions, Irvine, Calif., said foreclosure moratoria stemming from the coronavirus pandemic kept new foreclosure filings low—but warned they could increase dramatically once those moratoria expire.

Tag: MBA National Delinquency Survey

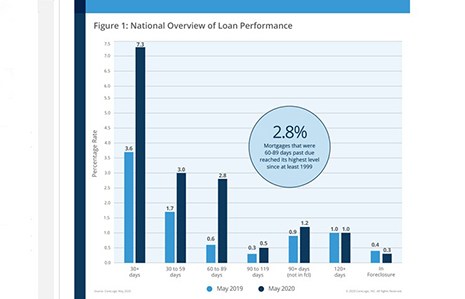

CoreLogic: ‘Clouds on The Horizon’ for Many U.S. Homeowners as Delinquency Rates Climb

Ahead of this week’s 2nd Quarter National Delinquency Survey from the Mortgage Bankers Association, CoreLogic, Irvine, Calif., said early-stage and adverse mortgage delinquency rates increased for the second consecutive month, with all 50 states and more than 75% of U.S. metro areas seeing increases in overall delinquency rates.

MBA Reports Rise in 1st Quarter Mortgage Delinquencies

Mortgage delinquencies rose in the first quarter as the economic effects of the coronavirus pandemic began to take hold, the Mortgage Bankers Association reported this morning.

ATTOM: Pre-COVID-19, Steady Rates for Equity-Rich Homeowners

ATTOM Data Solutions, Irvine, Calif., said data gathered before the impact of the coronavirus pandemic showed equity-rich American homeowners dipped slightly in the first quarter, even as the share of seriously underwater homeowners edged up.

Auction.com: Most Default Servicers Expect 2020 Foreclosures to Increase

Auction.com, Irvine, Calif., said its 2020 Default Servicing Insights report found while most respondents said they do not expect an economic recession in 2020, two-thirds expect their foreclosure and REO inflow to increase and 89 percent expect an increase in foreclosure and REO inflow from government-insured loans.

Black Knight First Look: Mortgage Delinquencies Fall to Lowest Level on Record

Black Knight, Jacksonville, issued its First Look Mortgage Monitor, reporting mortgage delinquencies fell by more than 5% in January, hitting their lowest level on record dating back to 2000.

MBA: 4Q Mortgage Delinquencies Fall to 40-Year Low

Mortgage delinquency rates for loans on one-to-four-unit residential properties in the fourth quarter fell to the lowest level since the Mortgage Bankers Association began tracking such data.

Black Knight’s First Look: Strong Decline in October Mortgage Delinquencies; Refis Pushes Prepayments to Highest Level in 6 Years

Black Knight, Jacksonville, Fla., said its First Look Mortgage Monitor reported the national mortgage delinquency rate fell to 3.39% in October, a nearly 7% decline from the past year and within 0.03% of the record low set in May.

MBA: Mortgage Delinquencies Fall to Lowest Level in Nearly 25 Years

Delinquency rates for mortgage loans on one-to-four-unit residential properties fell to their lowest level since 1995, the Mortgage Bankers Association reported Thursday.

MBA: Mortgage Delinquencies Fall to Lowest Level in Nearly 25 Years

Delinquency rates for mortgage loans on one-to-four-unit residential properties fell to their lowest level since 1995, the Mortgage Bankers Association reported yesterday.