Despite a small uptick in overall delinquencies, serious delinquencies continued to decrease, CoreLogic, Irvine, Calif., reported this morning.

Tag: MBA National Delinquency Survey

MBA: 1Q Mortgage Delinquencies Continue to Drop

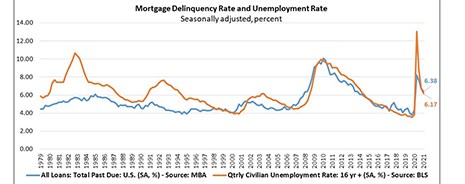

The Mortgage Bankers Association on Friday reported the delinquency rate for mortgage loans on one-to-four-unit residential properties fell to 6.38 percent of all loans outstanding, seasonally adjusted, at the end of the first quarter.

Black Knight: Delinquencies at Record Low: MBA to Release National Delinquency Survey Friday

Ahead of this Friday’s release of the Mortgage Bankers Association’s 1st Quarter National Delinquency Survey, Black Knight, Jacksonville, Fla., said just 217,000 homeowners became past due on their mortgages in March, the lowest such delinquency inflow of any month on record.

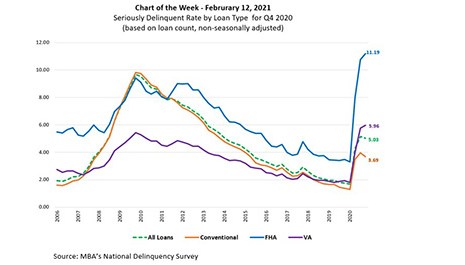

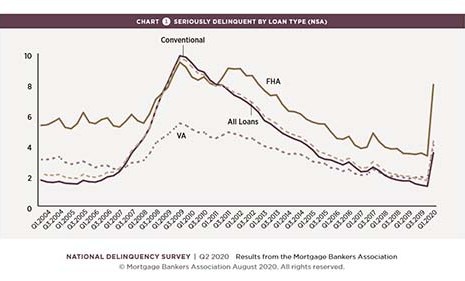

MBA Chart of the Week: NDS Seriously Delinquent Rate By Loan Type

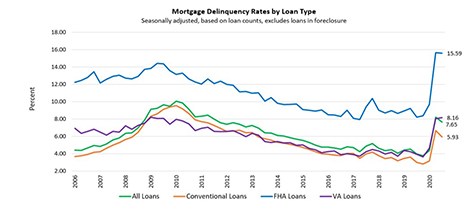

MBA last week released its National Delinquency Survey results for the fourth quarter. The delinquency rate for mortgage loans on one-to-four-unit residential properties at the end of the quarter decreased from a seasonally adjusted rate of 7.65 percent of all loans outstanding in the third quarter to 6.73 percent in the fourth quarter. This 92-basis-point drop in the delinquency rate was the biggest quarterly decline in the history of MBA’s survey dating back to 1979.

MBA: 4th Quarter Delinquencies See Decline from 3Q, Up from Year Ago; Foreclosure Inventory at Near 40-Year Low

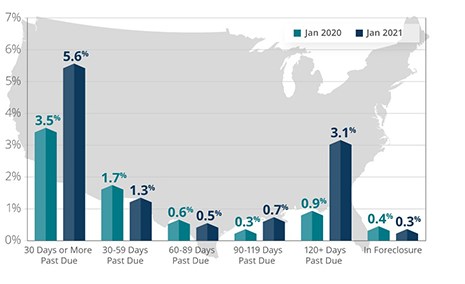

The Mortgage Bankers Association’s 4th Quarter National Delinquency Survey reported the delinquency rate for mortgage loans fell by 92 basis points from the third quarter to 6.73 percent, seasonally adjusted. From a year ago, however, mortgage delinquencies increased across the board.

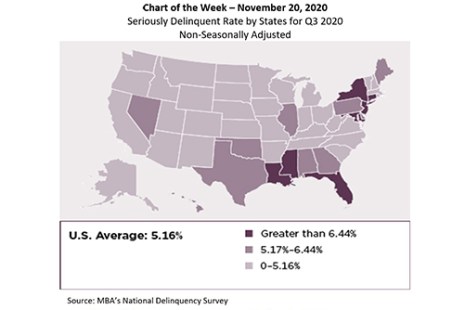

MBA Chart of the Week: Seriously Delinquent Rate by States for Q3 2020

This week’s chart highlights the seriously delinquent rate – the percentage of loans that are 90 days or more delinquent or in the process of foreclosure – in every state across the country.

MBA: Mortgage Delinquencies Decrease in 3Q

Mortgage delinquency and foreclosure rates fell in the third quarter, the Mortgage Bankers Association reported in its quarterly National Delinquency Survey.

CoreLogic: Foreclosures Remain Low; Serious Delinquencies Continue to Build Up

Ahead of this morning’s quarterly National Delinquency Survey from the Mortgage Bankers Association, CoreLogic, Irvine, Calif., said the 150-day delinquency rate reached its highest level since January 1999, noting that forbearance provisions have helped foreclosure rates maintain historic lows.

MBA: Mortgage Delinquencies Spike in Second Quarter

The Mortgage Bankers Association’s released its Second Quarter National Delinquency Survey, showing the delinquency rate for mortgage loans on one-to-four-unit residential properties increased to a seasonally adjusted rate of 8.22 percent of all loans outstanding.

MBA: Mortgage Delinquencies Spike in Second Quarter

The Mortgage Bankers Association’s released its Second Quarter National Delinquency Survey, showing the delinquency rate for mortgage loans on one-to-four-unit residential properties increased to a seasonally adjusted rate of 8.22 percent of all loans outstanding.