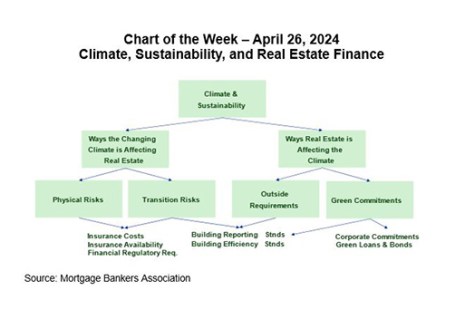

With Earth Day happening this month, it seems an opportune time to discuss the intersection of climate/sustainability issues and real estate finance. MBA has been leading on these issues for more than half a decade, helping members through our work related to research, policy and practice.

Tag: MBA Chart of the Week

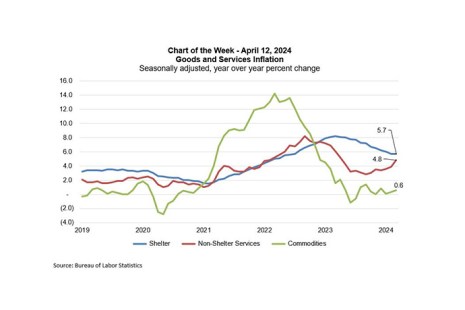

MBA Chart of the Week: Goods and Services Inflation

The week’s news has been around the Consumer Price Index (CPI) release showing that inflation was hotter than expected in March, which is likely to delay the Federal Reserve’s first rate cut in 2024 and contributed to a significant spike in the 10-year Treasury yield to over 4.5%.

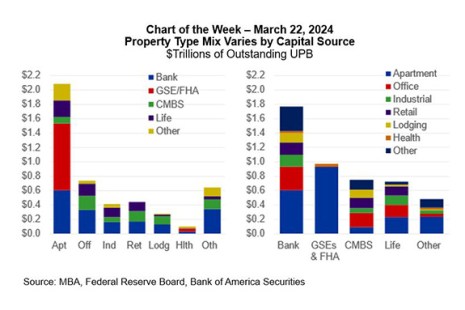

MBA Chart of the Week: CRE Mortgage Debt Across Capital Sources, Property Types

This week’s Chart of the Week shows MBA’s estimates of the distribution of CRE mortgage debt across capital sources and property types and is derived from a variety of public and private sources.

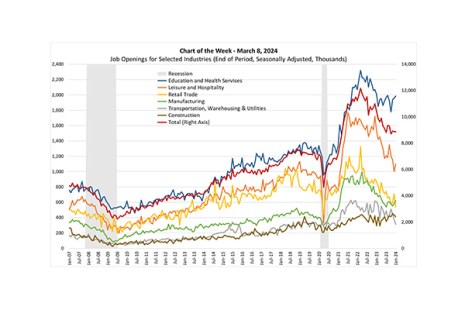

MBA Chart of the Week: Job Openings for Selected Industries

Last week Fed Chair Jay Powell testified to Congress that as “labor market tightness has eased and progress on inflation has continued, the risks to achieving our employment and inflation goals have been moving into better balance.”

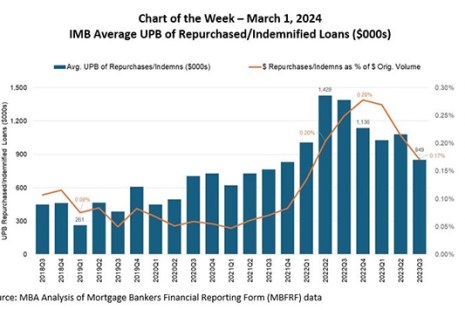

MBA Chart of the Week: IMB Average UPB of Repurchased/Indemnified Loans

MBA Research recently analyzed repurchase and indemnification volume over a five-year period from the third quarter of 2018 through the third quarter of 2023.

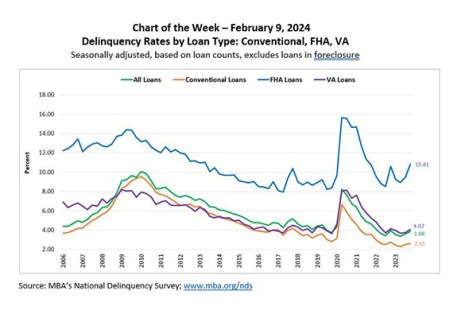

MBA Chart of the Week: Delinquency Rates by Loan Type

According to the latest MBA National Delinquency Survey (NDS), the overall delinquency rate for mortgage loans on one‐to‐four‐unit residential properties increased to a seasonally adjusted rate of 3.88% of all loans outstanding at the end of the fourth quarter of 2023.

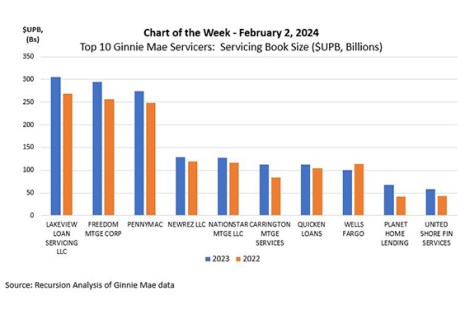

MBA Chart of the Week: Top 10 Ginnie Mae Servicers

This week’s MBA Chart of the Week highlights analysis by Recursion, a big data mortgage analytics firm, that ranks the 10 largest Ginnie servicers by servicing book size ($UPB).

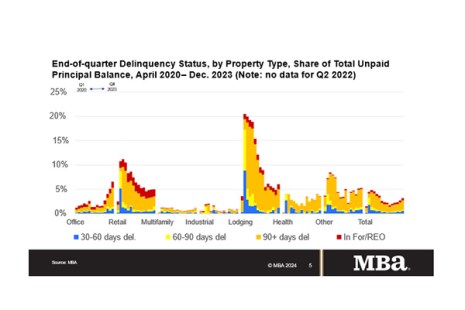

MBA Chart of the Week: End of Quarter Delinquency Status

Ongoing challenges in commercial real estate markets pushed the delinquency rate on CRE-backed loans higher in the final three months of 2023.

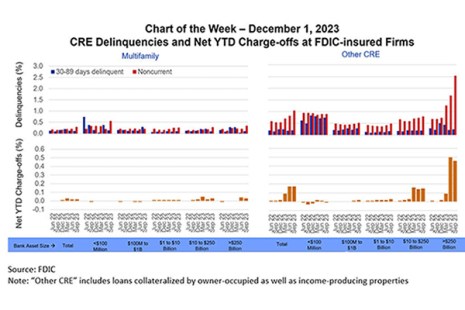

MBA Chart of the Week: CRE Delinquencies and Net YTD Charge-offs at FDIC-Insured Firms

Since March 2023, a recurring set of questions has revolved around a) how conditions in commercial real estate are affecting banks and b) how conditions with banks are affecting CRE.

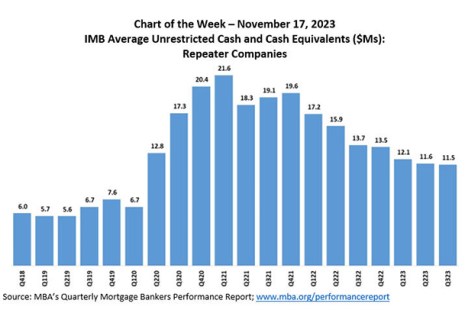

MBA Chart of the Week: IMB Average Unrestricted Cash & Cash Equivalents

MBA Research recently released the third quarter results of its Quarterly Mortgage Bankers Performance Report.