The Mortgage Bankers Association’s monthly Loan Monitoring Survey revealed that the total number of loans now in forbearance increased to 0.23% as of June 30, 2024.

Tag: Marina Walsh

Chart of the Week: Annual Cost of Servicing Performing and Non-Performing Loans

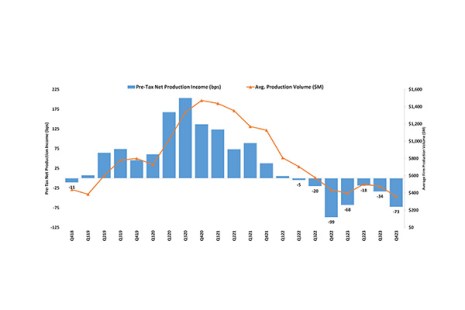

MBA’s annual Servicing Operations Study and Forum includes a deep-dive analysis and discussion of servicing costs, productivity, and portfolio characteristics for in‐house single-family servicers, representing about 60 percent of the single-family servicing market. Based on the most recent completed study cycle, fully-loaded servicing costs remained flat relative to the previous year at an average of $237 per loan. But that only tells part of the story.

MBA: IMBs Report Net Production Losses in the First Quarter of 2024

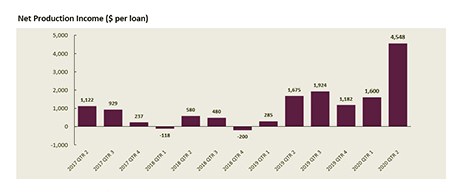

Independent mortgage banks (IMBs) and mortgage subsidiaries of chartered banks reported a pre-tax net loss of $645 on each loan they originated in the first quarter of 2024, a decrease from the reported loss of $2,109 per loan in the fourth quarter of 2023, according to the Mortgage Bankers Association’s (MBA) newly released Quarterly Mortgage Bankers Performance Report.

MBA: Mortgage Delinquencies Increase Slightly in First Quarter

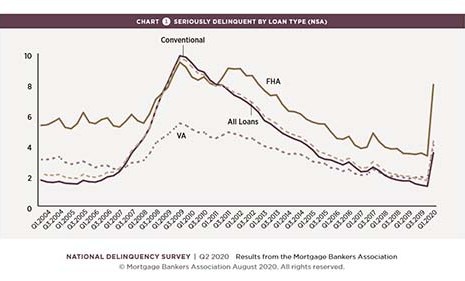

The delinquency rate for mortgage loans on one-to-four-unit residential properties increased to a seasonally adjusted rate of 3.94% of all loans outstanding at the end of the first quarter of 2024, according to the Mortgage Bankers Association’s National Delinquency Survey.

MBA Reports Share of Mortgage Loans in Forbearance Holds Steady at 0.22% in February

The Mortgage Bankers Association’s monthly Loan Monitoring Survey revealed the total number of loans now in forbearance remained unchanged at 0.22% as of Feb. 29, 2024.

MBA: IMBs Report Net Production Losses in the Fourth Quarter of 2023

Independent mortgage banks and mortgage subsidiaries of chartered banks reported a pre-tax net loss of $2,109 on each loan they originated in the fourth quarter of 2023, an increase from the reported loss of $1,015 per loan in the third quarter of 2023, according to the Mortgage Bankers Association’s newly released Quarterly Mortgage Bankers Performance Report.

CoreLogic: Foreclosures Remain Low; Serious Delinquencies Continue to Build Up

Ahead of this morning’s quarterly National Delinquency Survey from the Mortgage Bankers Association, CoreLogic, Irvine, Calif., said the 150-day delinquency rate reached its highest level since January 1999, noting that forbearance provisions have helped foreclosure rates maintain historic lows.

MBA Forecast: 2020 Best Year For Industry Since 2003; 2021 Purchase Originations to Increase to Record $1.54 Trillion

In its latest forecast, the Mortgage Bankers Association said purchase originations are expected to grow by 8.5% to a record $1.54 trillion in 2021. And after a substantial 70.9% jump in activity in 2020, MBA anticipates refinance originations to slow next year, decreasing by 46.3% to $946 billion.

MBA: Strong Borrower Demand, Low Rates Fuel 2Q IMB Production Profits

Independent mortgage banks and mortgage subsidiaries of chartered banks reported a net gain of $4,548 on each loan they originated in the second quarter, up from $1,600 per loan in the first quarter, according to the Mortgage Bankers Association’s Quarterly Mortgage Bankers Performance Report.

MBA: Mortgage Delinquencies Spike in Second Quarter

The Mortgage Bankers Association’s released its Second Quarter National Delinquency Survey, showing the delinquency rate for mortgage loans on one-to-four-unit residential properties increased to a seasonally adjusted rate of 8.22 percent of all loans outstanding.