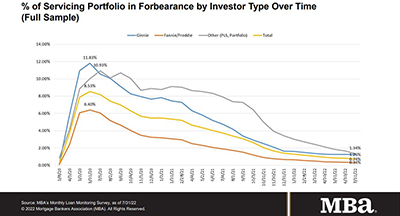

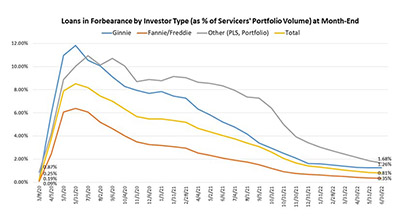

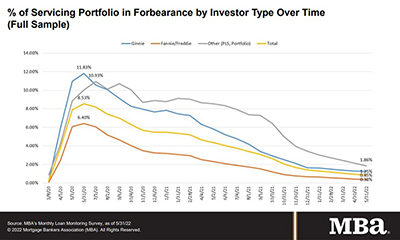

The Mortgage Bankers Association’s monthly Loan Monitoring Survey reported loans in forbearance decreased by 7 basis points to 0.74% of servicers’ portfolio volume as of July 31, from 0.81% in June. MBA estimates 370,000 homeowners remain in forbearance plans.

Tag: Marina Walsh CMB

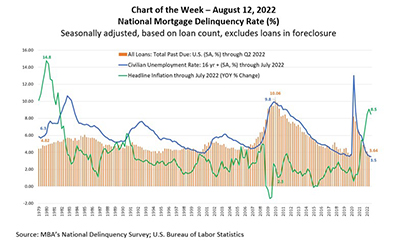

MBA Chart of the Week, Aug. 12, 2022: National Mortgage Delinquency Rate

This week’s MBA Chart of the Week highlights the relationship between MBA’s mortgage delinquency rate and two economic indicators, the unemployment rate, and year-over-year changes in headline inflation – measuring the price of goods and services in the economy.

July Mortgage Loan Forbearance Rate Falls to 0.74%

The Mortgage Bankers Association’s monthly Loan Monitoring Survey reported loans in forbearance decreased by 7 basis points to 0.74% of servicers’ portfolio volume as of July 31, from 0.81% in June. MBA estimates 370,000 homeowners remain in forbearance plans.

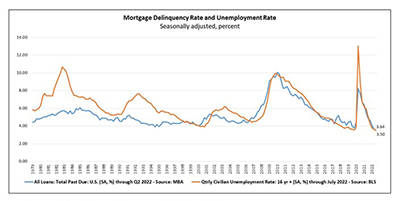

MBA: 2Q Mortgage Delinquency Rate at Record Low

The second quarter mortgage delinquency rate fell to a record low—even beating out pre-pandemic lows—the Mortgage Bankers Association reported Thursday.

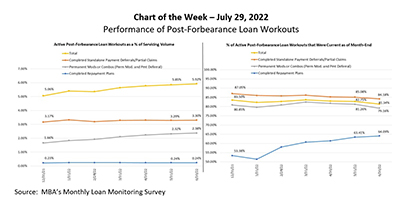

MBA Chart of the Week: Performance of Post-Forbearance Loan Workouts

According to MBA’s Monthly Loan Monitoring Survey, the share of loans in forbearance dropped slightly to 0.81 percent of servicers’ portfolio volume as of June 30, from 0.85 percent the prior month. Only about 404,000 homeowners are still in forbearance plans, after reaching a peak of nearly 4.3 million homeowners in May 2020.

MBA: Share of Mortgage Loans in Forbearance Decreases Slightly in June

he Mortgage Bankers Association’s monthly Loan Monitoring Survey revealed the total number of loans now in forbearance decreased by 4 basis points from 0.85% of servicers’ portfolio volume in May to 0.81% on June 30.

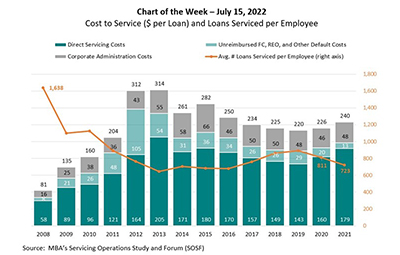

MBA Chart of the Week July 15 2022: Cost to Service Loans Per Employee

MBA’s annual Servicing Operations Study and Forum includes a deep-dive analysis and discussion of servicing costs, productivity, portfolio activity and operational metrics for in‐house servicers.

Share of Mortgage Loans in Forbearance Falls to 0.85%

Mortgage loans in forbearance fell to new post-pandemic lows in May, the Mortgage Bankers Association reported.

MBA: 1Q IMB Production Profits Decrease

Independent mortgage banks and mortgage subsidiaries of chartered banks reported a net gain of $223 on each loan they originated in the first quarter, a sharp drop from a reported gain of $1,099 per loan in the fourth quarter, the Mortgage Bankers Association reported Tuesday.

MBA: 1Q IMB Production Profits Decrease

Independent mortgage banks and mortgage subsidiaries of chartered banks reported a net gain of $223 on each loan they originated in the first quarter, a sharp drop from a reported gain of $1,099 per loan in the fourth quarter, the Mortgage Bankers Association reported Tuesday.