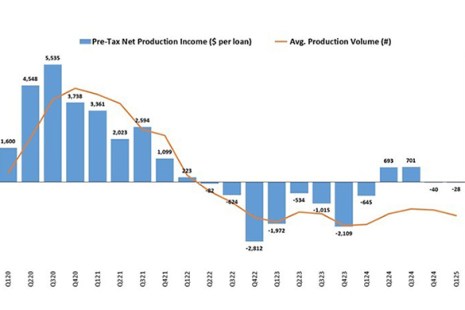

Independent mortgage banks and mortgage subsidiaries of chartered banks reported a pre-tax net loss of $28 on each loan they originated in the first quarter, compared to a net loss of $40 per loan in the fourth quarter of 2024, according to MBA’s newly released Quarterly Mortgage Bankers Performance Report.

Tag: Marina Walsh CMB

MBA: Commercial Mortgage Delinquency Rates Increase in Third Quarter

Commercial mortgage delinquencies increased in the third quarter of 2024, according to the Mortgage Bankers Association’s (MBA) latest Commercial Delinquency Report.

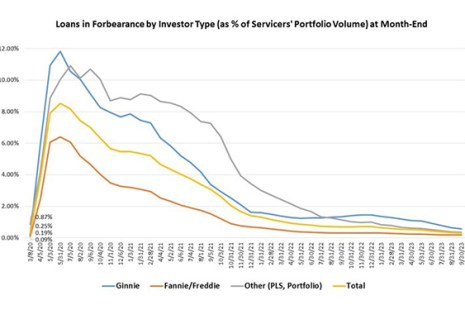

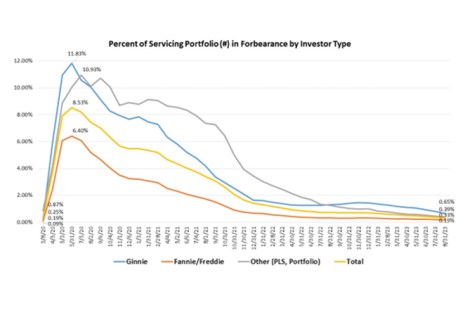

MBA: Share of Mortgage Loans in Forbearance Increases to 0.31% in August

The Mortgage Bankers Association’s monthly Loan Monitoring Survey revealed that the total number of loans now in forbearance increased to 0.31% as of August 31, 2024.

MBA: Share of Mortgage Loans in Forbearance Decreases Slightly to 0.21% in May

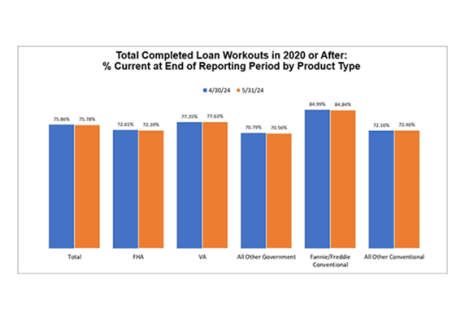

The Mortgage Bankers Association’s monthly Loan Monitoring Survey revealed the total number of loans now in forbearance declined slightly to 0.21% as of May 31, 2024.

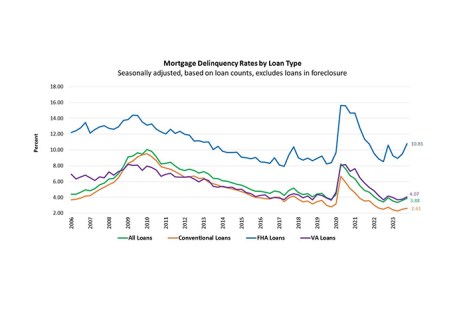

MBA: Mortgage Delinquencies Increase in the Fourth Quarter of 2023

The delinquency rate for mortgage loans on one-to-four-unit residential properties increased to a seasonally adjusted rate of 3.88% of all loans outstanding at the end of the fourth quarter of 2023, according to the Mortgage Bankers Association’s National Delinquency Survey.

MBA: Share of Mortgage Loans in Forbearance Decreases to 0.23% in December 2023

The Mortgage Bankers Association’s (MBA) monthly Loan Monitoring Survey revealed that the total number of loans now in forbearance decreased by 3 basis points from 0.26% of servicers’ portfolio volume in the prior month to 0.23% as of Dec. 31, 2023.

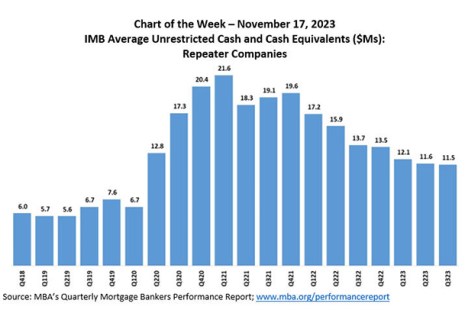

MBA Chart of the Week: IMB Average Unrestricted Cash & Cash Equivalents

MBA Research recently released the third quarter results of its Quarterly Mortgage Bankers Performance Report.

MBA: Share of Mortgage Loans in Forbearance Decreases to 0.31% in September

The Mortgage Bankers Association’s monthly Loan Monitoring Survey revealed that the total number of loans now in forbearance decreased by 2 basis points from 0.33% of servicers’ portfolio volume in the prior month to 0.31% as of September 30, 2023.

Share of Mortgage Loans in Forbearance Decreases to 0.33% in August

The Mortgage Bankers Association’s (MBA) monthly Loan Monitoring Survey revealed that the total number of loans now in forbearance decreased by 6 basis points from 0.39% of servicers’ portfolio volume in the prior month to 0.33% as of August 31, 2023. According to MBA’s estimate, 165,000 homeowners are in forbearance plans. Mortgage servicers have provided forbearance to approximately 7.92 million borrowers since March 2020.

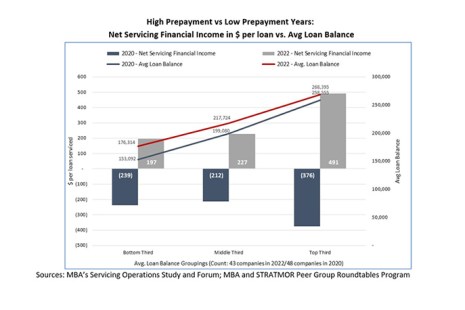

MBA White Paper Measures the Impact of Loan Sizes on Profitability Through Mortgage Cycles

The conventional wisdom is that originating and servicing higher balance loans means higher profits. However, according to a new white paper by the Mortgage Bankers Association titled, How do Mortgage Revenues, Costs and Profitability Vary by Loan Balance? An Analysis Using Benchmarking Data, the relationship between loan balance and profitability is more nuanced and may change over the course of market cycles.