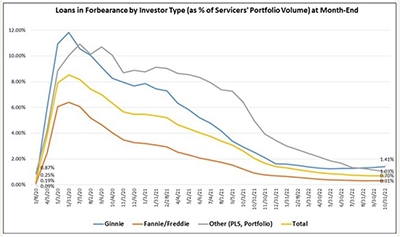

The Mortgage Bankers Association’s monthly Loan Monitoring Survey reported loans in forbearance increased by 1 basis point to 0.70% of servicers’ portfolio volume from 0.69% in the prior month as of October 31.

Tag: Marina Walsh CMB

MBA: October Share of Mortgage Loans In Forbearance Up Slightly

The Mortgage Bankers Association’s monthly Loan Monitoring Survey reported loans in forbearance increased by 1 basis point to 0.70% of servicers’ portfolio volume from 0.69% in the prior month as of October 31.

MBA Report: IMBs Report 3Q Losses

Independent mortgage banks and mortgage subsidiaries of chartered banks reported a net loss of $624 on each loan originated in the third quarter, the Mortgage Bankers Association reported Friday.

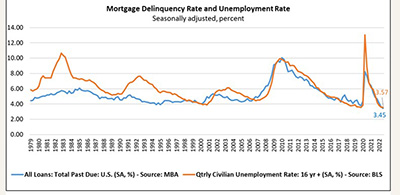

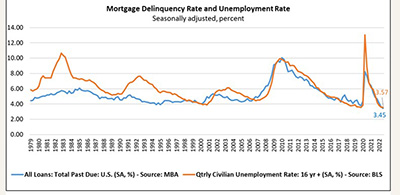

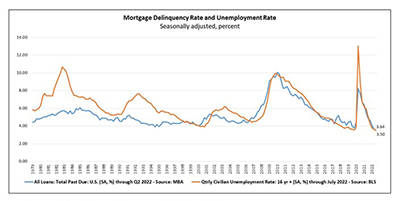

MBA: 3Q Mortgage Delinquencies Fall to New Survey Low

The Mortgage Bankers Association on Thursday released its 3rd Quarter National Delinquency Survey, reporting delinquency rate for mortgage loans on one-to-four-unit residential properties fell to its lowest level since the Survey’s inception.

MBA: 3Q Mortgage Delinquencies Fall to New Survey Low

The Mortgage Bankers Association on Thursday released its 3rd Quarter National Delinquency Survey, reporting delinquency rate for mortgage loans on one-to-four-unit residential properties fell to its lowest level since the Survey’s inception.

MBA Forecast: Recession Likely in 2023, Mortgage Originations to Decline 9% to $2.05 Trillion

NASHVILLE—The Mortgage Bankers Association said total mortgage origination volume is expected to decline to $2.05 trillion in 2023 from the $2.26 trillion expected in 2022. Purchase originations are forecast to decrease by 3 percent to $1.53 trillion next year, while refinance volume is anticipated to decline by 24 percent to $513 billion.

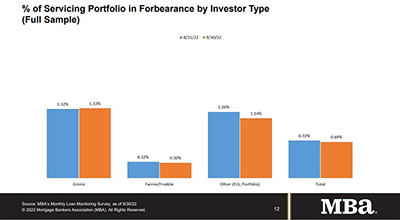

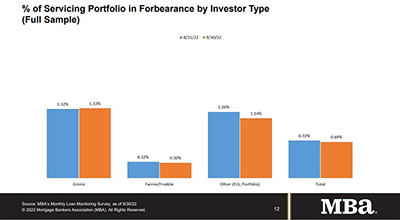

MBA: September Share of Mortgage Loans in Forbearance Decreases to 0.69%

The Mortgage Bankers Association’s monthly Loan Monitoring Survey reported loans in forbearance decreased by 3 basis points to 0.69% of servicers’ portfolio volume as of Sept. 30, down from 0.72% in August. MBA estimates 345,000 homeowners remain in forbearance plans.

MBA: September Share of Mortgage Loans in Forbearance Decreases to 0.69%

The Mortgage Bankers Association’s monthly Loan Monitoring Survey reported loans in forbearance decreased by 3 basis points to 0.69% of servicers’ portfolio volume as of Sept. 30, down from 0.72% in August. MBA estimates 345,000 homeowners remain in forbearance plans.

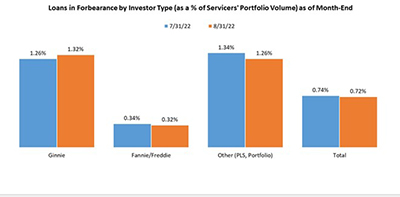

MBA: August Share of Mortgage Loans in Forbearance Falls to 0.72%

The Mortgage Bankers Association’s monthly Loan Monitoring Survey reported loans now in forbearance decreased by 2 basis points from 0.74% of servicers’ portfolio volume in the prior month to 0.72% as of August 31. MBA estimates 360,000 homeowners are in forbearance plans.

MBA: 2Q Mortgage Delinquency Rate at Record Low

The second quarter mortgage delinquency rate fell to a record low—even beating out pre-pandemic lows—the Mortgage Bankers Association reported Thursday.