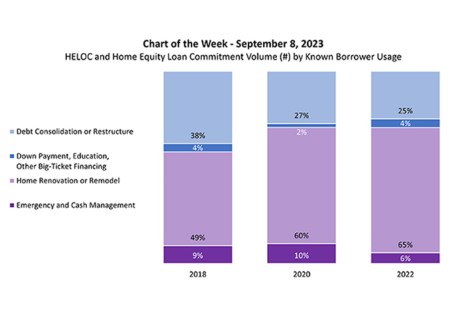

Dollar volume of open-end home equity lines of credit (HELOCs) and closed-end home equity loans originated in 2022 increased 50 percent compared to 2020, driven by home renovation or remodeling, according to MBA’s latest Home Equity Lending Study. This week’s Chart of the Week explores the known reasons that borrowers take out a HELOC or home equity loan, according to participants in our study.

Tag: Marina Walsh CMB

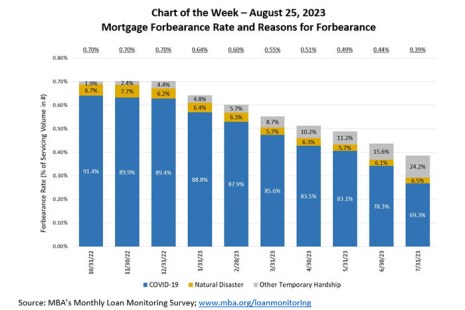

MBA Chart of the Week Aug. 28: Mortgage Forbearance Rate and Reasons for Forbearance

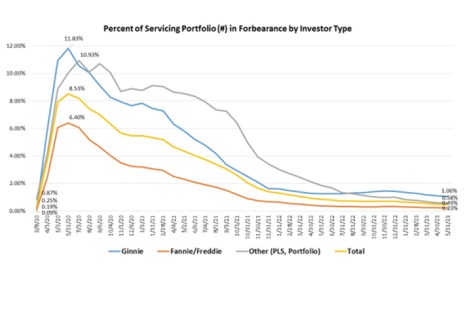

According to the July results from MBA’s Monthly Loan Monitoring Survey, the total number of loans now in forbearance decreased by 5 basis points from 0.44% of servicers’ portfolio volume in the prior month to 0.39% as of July 31, 2023.

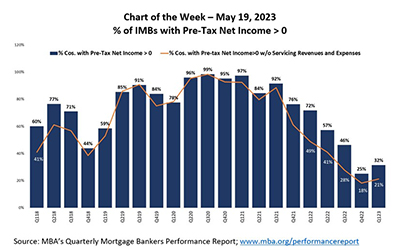

MBA: IMBs Report Net Production Losses in the Second Quarter

Independent mortgage banks and mortgage subsidiaries of chartered banks reported a pre-tax net loss of $534 on each loan they originated in the second quarter, an improvement from the reported loss of $1,972 per loan in the first quarter of 2023, according to the Mortgage Bankers Association’s Quarterly Mortgage Bankers Performance Report.

MBA: Share of Mortgage Loans in Forbearance Decreases to 0.39% in July

The Mortgage Bankers Association’s (MBA) monthly Loan Monitoring Survey revealed that the total number of loans now in forbearance decreased by 5 basis points from 0.44% of servicers’ portfolio volume in the prior month to 0.39% as of July 31.

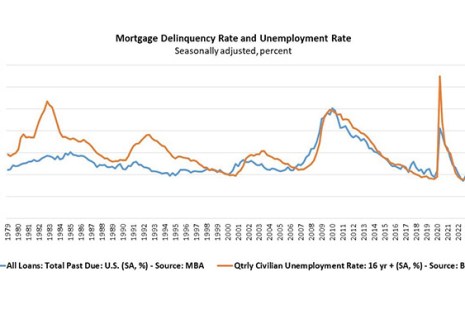

MBA: Mortgage Delinquencies Decrease in Second Quarter

The delinquency rate for mortgage loans on one-to-four-unit residential properties decreased to a seasonally adjusted rate of 3.37 percent of all loans outstanding at the end of the second quarter, according to the Mortgage Bankers Association’s National Delinquency Survey.

MBA: Home Equity Lending Volume Rose in 2022 as Home Renovations Drive Demand

Originations of open-ended Home Equity Lines of Credit and closed-end home equity loans increased 50% in 2022 compared to two years earlier. This is according to the Mortgage Bankers Association’s Home Equity Lending Study, released for the first time since 2020.

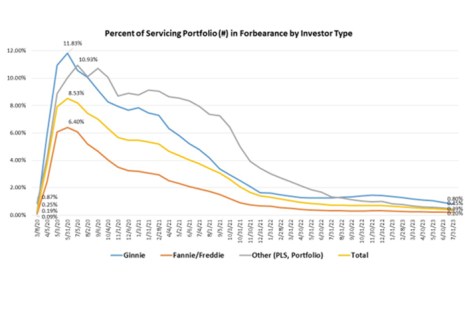

MBA: Share of Mortgage Loans in Forbearance Decreases to 0.44% in June

The Mortgage Bankers Association’s monthly Loan Monitoring Survey revealed the total number of loans now in forbearance decreased by 5 basis points to 0.44% of servicers’ portfolio volume as of June 30, 2023.

MBA: Share of Mortgage Loans in Forbearance Drops to 0.49% in May

The total number of loans now in forbearance decreased to 0.49% for May from 0.51% of servicers’ portfolio volume in April, the Mortgage Bankers Association’s monthly Loan Monitoring Survey reported.

MBA: Share of Mortgage Loans in Forbearance Drops to 0.49% in May

The total number of loans now in forbearance decreased to 0.49% for May from 0.51% of servicers’ portfolio volume in April, the Mortgage Bankers Association’s monthly Loan Monitoring Survey reported.

MBA Chart of the Week May 19, 2023: % of IMBs with Pre-Tax Net Income

Today’s Chart of the Week compares the percentage of companies in the QPR that reported positive pre-tax net income including all lines of business (e.g. production and servicing operations), versus the percentage of companies that reported positive pre-tax net income, once servicing operations are excluded.