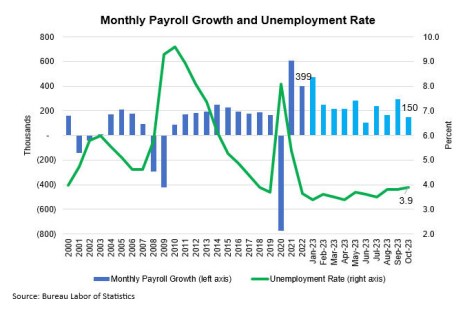

The U.S. economy added 150,000 nonfarm employment jobs in October, the U.S. Bureau of Labor Statistics reported.

Tag: Joel Kan

MBA Chart of the Week: Monthly Payroll Growth and Unemployment Rate

This week’s Chart of the Week highlights the October Employment Situation results released Friday.

MBA Forecast: Recession Likely in 2023, Mortgage Originations to Decline 9% to $2.05 Trillion

NASHVILLE—The Mortgage Bankers Association said total mortgage origination volume is expected to decline to $2.05 trillion in 2023 from the $2.26 trillion expected in 2022. Purchase originations are forecast to decrease by 3 percent to $1.53 trillion next year, while refinance volume is anticipated to decline by 24 percent to $513 billion.

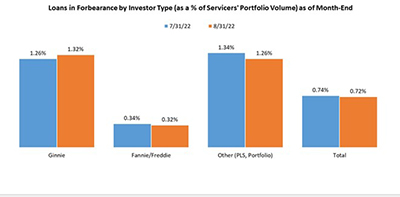

MBA: August Share of Mortgage Loans in Forbearance Falls to 0.72%

The Mortgage Bankers Association’s monthly Loan Monitoring Survey reported loans now in forbearance decreased by 2 basis points from 0.74% of servicers’ portfolio volume in the prior month to 0.72% as of August 31. MBA estimates 360,000 homeowners are in forbearance plans.

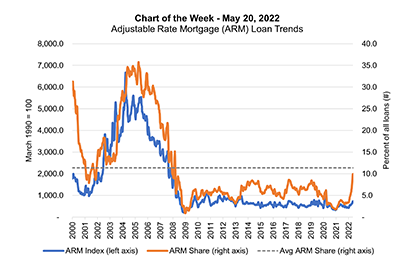

MBA Chart of the Week May 20, 2022: ARM Loan Trends

The recent increase in the adjustable-rate mortgage share of applications has caught the attention of market participants and the media. The ARM share has increased from 3.1 percent in the first week of January to 10.3 percent as of the week ending May 13, peaking at 10.8 percent the week prior.

Highlights of MBA’s Revised May Forecasts

The Mortgage Bankers Association released its revised monthly Economic Forecast and monthly Mortgage Finance Forecast. Here are highlights and commentary from MBA Associate Vice President of Economic and Industry Forecasting Joel Kan.

MBA Economists: Outlook Strong for Originations, Servicing

ORLANDO—Despite another potentially economy-altering event this week—this time, the Russian invasion of Ukraine—Mortgage Bankers Association economists said the current picture for mortgage originators and servicers remains upbeat.

MBA Forecast: 2022 Purchase Originations to Increase 9% to Record $1.7 Trillion

SAN DIEGO–The Mortgage Bankers Association said purchase mortgage originations are expected to grow 9% to a record $1.725 trillion in 2022.

MBA Forecast: 2022 Purchase Originations to Increase 9% to Record $1.7 Trillion

SAN DIEGO–The Mortgage Bankers Association said purchase mortgage originations are expected to grow 9% to a record $1.725 trillion in 2022.

MBA Forecast: 2020 Best Year For Industry Since 2003; 2021 Purchase Originations to Increase to Record $1.54 Trillion

In its latest forecast, the Mortgage Bankers Association said purchase originations are expected to grow by 8.5% to a record $1.54 trillion in 2021. And after a substantial 70.9% jump in activity in 2020, MBA anticipates refinance originations to slow next year, decreasing by 46.3% to $946 billion.