Fueled by strong market fundamentals and low interest rates, 2,589 different multifamily lenders provided $364.4 billion in new mortgages in 2019 for apartment buildings with five or more units, according to the Mortgage Bankers Association’s 2019 Multifamily Lending Report.

Tag: Jamie Woodwell

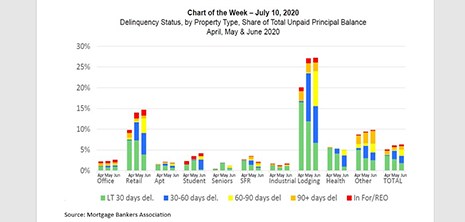

MBA Chart of the Week: Delinquency Status of Unpaid Principal Balance 2nd Quarter

The $3.7 trillion commercial and multifamily mortgage market is really a confederation of different capital sources, property types and geographic markets, all bound together by the provision of mortgage capital backed by investment property incomes and collateral value. Often, the overall market moves in tandem. At other times – like now – different segments act very differently.

Andrew Foster: Preferred Equity Plan for Commercial Real Estate Comes to Washington

Here in Washington, ongoing COVID-19 relief discussions have reached the commercial real estate borrowing community and their financiers in earnest.

MBA: 1st Quarter Commercial/Multifamily Mortgage Debt Outstanding Up 1.7%

Commercial/multifamily mortgage debt outstanding rose by $61.0 billion (1.7 percent) in the first quarter, according to the Mortgage Bankers Association’s quarterly Commercial/Multifamily Mortgage Debt Outstanding report.

MBA: 1QCommercial, Multifamily Mortgage Delinquencies Remain Low

Commercial and multifamily mortgage delinquencies remained low at the end of the first quarter, the Mortgage Bankers Association said in its first quarter Commercial/Multifamily Delinquency Report.

Andrew Foster: Case-By-Case–Commercial Mortgage Forbearance Consideration Begins

While the hope remains that the recession will be short-lived with a strong recovery in the second half of 2020, commercial real estate typically lags the broader economy. Any quick relief for the commercial mortgage industry will be due in part to government relief efforts. It will take patience from market participants before a clear picture of various outcomes emerges, in part because so much of the CRE finance market impacted by COVID-19 is entering into forbearance agreements.

MBA: Commercial/Multifamily Mortgage Debt Grows by Largest Annual Amount Since 2006

The Mortgage Bankers Association reported commercial/multifamily mortgage debt outstanding at the end of 2019 rose by $248 billion (7.3 percent) from a year ago.

MBA: 4Q Commercial/Multifamily Mortgage Delinquencies Remain Low

Commercial and multifamily mortgage delinquencies remained low in the fourth quarter, according to the Mortgage Bankers Association’s Commercial/Multifamily Delinquency Report.

#CREF2020: PNC, Wells Fargo Lead MBA 2019 Year-End Commercial/Multifamily Servicer Rankings

SAN DIEGO–The Mortgage Bankers Association released its year-end ranking of commercial and multifamily mortgage servicers’ volumes as of December 31, here at the MBA 2020 Commercial Real Estate Finance/Multifamily Housing Convention & Expo.

#CREF2020: MBA Says 2020 Commercial/Multifamily Mortgage Maturity Volumes to ‘Return to Normalcy’

SAN DIEGO—The Mortgage Bankers Association said $163.2 billion of the $2.2 trillion (7 percent) of outstanding commercial and multifamily mortgages held by non-bank lenders and investors will mature in 2020, a 48 percent increase from the $110.5 billion that matured in 2019.