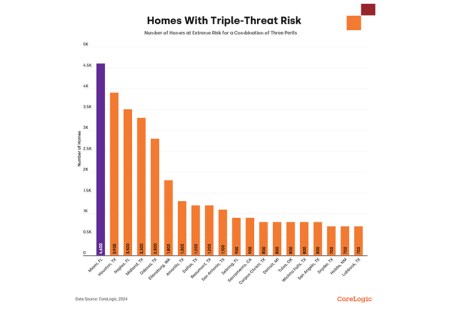

CoreLogic, Irvine, Calif., reported that across the U.S., 33,000 homes face a triple threat–essentially, year-round extreme risk from three natural disasters.

Tag: Insurance

Neptune Flood Highlights Severe Impact of Hurricanes Helene, Milton

Neptune Flood, St. Petersburg, Fla., recently released an analysis of the aftermath of hurricanes Helene and Milton, specifically regarding the U.S. flood insurance market.

ValuePenguin: Winter Weather Property Damage Already at $61.8M in 2024

As we head into the winter months in much of the United States, ValuePenguin, a division of LendingTree, Charlotte, N.C., put out a report on winter weather damage. So far, winter weather has caused an estimated $61.8 million in property damage in 2024.

Hurricane Helene Is Making Young Americans Rethink Future Residence, Redfin Finds

Hurricane Helene has now become one of the deadliest hurricanes in the U.S. in modern times–and its destructive path may be affecting residential decisions moving forward.

Mphasis: Prospective Home Buyers Worry About Costs, Insurance

Mphasis Digital Risk, Maitland Fla., conducted a study finding that prospective home buyers say home insurance affordability is a major factor in where they decide to move.

Incenter’s Alison Tulio and Craig Eagleson on Softening the Impact of Spiking Escrows

High valuations and interest rates are not the only factors that have negatively impacted the mortgage industry. Added to these major hurdles, spiking escrows due to rising property tax assessments and homeowners insurance costs are pushing some borrowers to the brink of default.

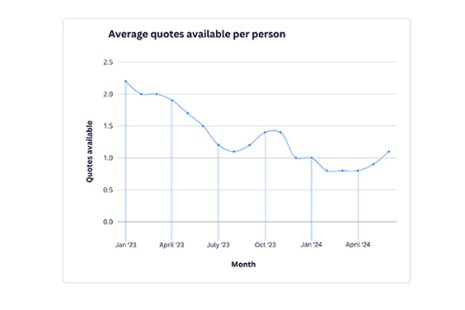

Two-Thirds of Homes Underinsured, Matic Reports

Matic, Columbus, Ohio, released its mid-year premium trends report, finding that approximately two-thirds of homes are underinsured, largely due to insurance policies that fail to reflect construction costs or home improvements.

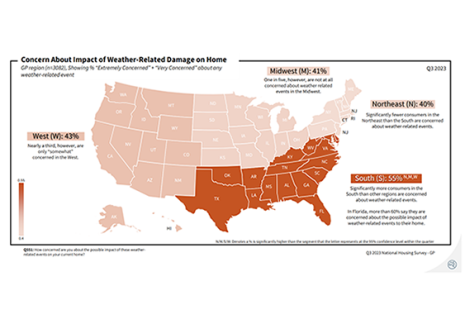

Fannie Mae: Consumers Worry About Extreme Weather on Homes, Insurance Premiums

Nearly half of Americans surveyed expressed concern about the impact of extreme weather events on their homes–especially about excessive wind and heat–according to Fannie Mae, Washington, D.C.

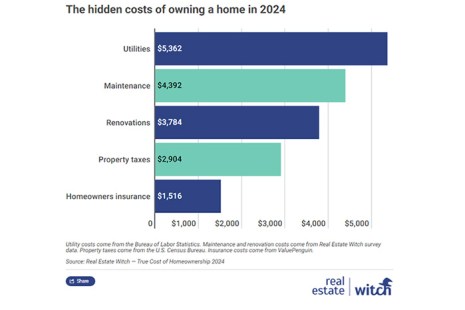

Homeowners Average Almost $18,000 Per Year on Non-Mortgage Expenses

The average homeowner spends $17,958 on non-mortgage expenses, a recent study found, listing categories such as maintenance, improvements, utilities, property taxes and insurance.

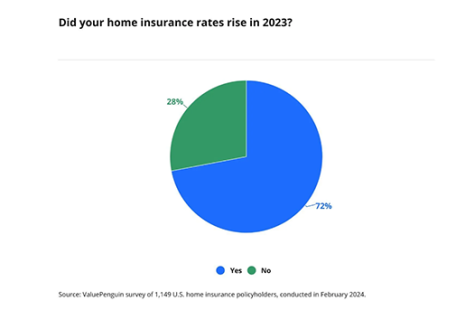

LendingTree: 1 in 4 Worry Their Home Will Be ‘Uninsurable’ in 2024

More than one-quarter of U.S. homeowners worry their homes will become “uninsurable” as rates continue to increase, reported LendingTree, Charlotte, N.C.