Matic, Columbus, Ohio, reported that after a few years of significant rate increases, home insurance premium growth began to slow in 2025.

Tag: Insurance

Realtor.com: Recent, Prospective Homebuyers Stressed About Insurance Affordability

Realtor.com, Santa Clara, Calif., released a new survey finding that 75% of recent and prospective homebuyers believe homeowners insurance could become unaffordable for them.

Matic: Home Insurance Affordability Crisis Grows

The housing market face growing challenges as homeowners’ insurance affordability concerns and coverage limitations persist, according to Matic, Columbus, Ohio.

Cotality: Taxes, Insurance Appear to Drive Some Increase in Serious Delinquencies

Cotality, Irvine, Calif., released a new report analyzing the effects of property taxes and insurance in states seeing upticks in serious mortgage delinquencies.

Southern Discomfort: Weather, Economic Headwinds Drive Home Insurance Premiums Through the Roof

For prospective home buyers already grappling with affordability constraints from rising home prices and elevated interest rates, this additional expense further chokes their budgets and erodes their house-buying power.

Maxwell: Many American Homeowners Stressed About Cost, Availability of Insurance

Maxwell, Denver, found nearly half–or 46%–of American homeowners are currently questioning whether they can continue to afford their homes due to rising insurance and property tax costs.

LendingTree: 13.6% of Homes Are Uninsured

LendingTree, Charlotte, N.C., reported approximately one in seven homes across the U.S. are uninsured.

Servicing Panel Talks AI, Insurance, Future Trends

DALLAS–What’s next for the servicing industry when it comes to trends and challenges in technology, regulation and the overall market?

Neptune Flood: 20M Homes at Flood Risk, but Only 3.8M Insured

Neptune Flood, St. Petersburg, Fla., released an analysis of the U.S. residential flood insurance market, finding that while 20 million U.S. homes are at moderate-to-severe flood risk, only 3.8 million are insured.

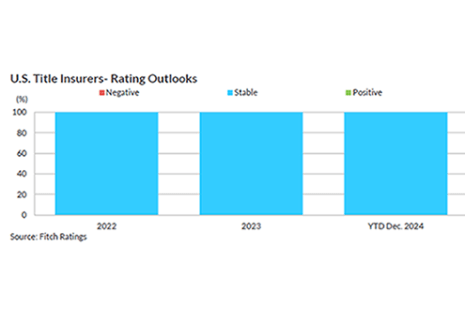

Fitch: Increased Originations Will Benefit Title Insurers in 2025

Continued housing market resiliency will benefit U.S. title insurers in 2025 as broader macro headwinds continue to subside, according to Fitch Ratings, New York.