The Consumer Financial Protection Bureau on Monday made Home Mortgage Disclosure Act Modified Loan Application Register data for 2022 available through the Federal Financial Institutions Examination Council’s HMDA Platform for more than 4,000 HMDA filers.

Tag: Home Mortgage Disclosure Act

CFPB Provides Guidance on HMDA Loan Reporting Threshold

The Consumer Financial Protection Bureau said it does not intend to “initiate enforcement actions or cite Home Mortgage Disclosure Act violations for failures to report closed-end mortgage data collected in 2022, 2021 and 2020” for covered institutions that originated at least 25 closed-end loans, but less than 100 closed-end loans in each of the previous two calendar years.

CFPB Issues RFI on Detecting Discrimination in Mortgage Lending

The Consumer Financial Protection Bureau on Nov. 16 issued a Request for Information seeking input on rules implementing the Home Mortgage Disclosure Act.

CFPB Issues RFI on Detecting Discrimination in Mortgage Lending

The Consumer Financial Protection Bureau on Nov. 16 issued a Request for Information seeking input on rules implementing the Home Mortgage Disclosure Act.

MBA Statement on The Markup’s ‘Flawed Analysis’ of Mortgage Lending

The Mortgage Bankers Association on Wednesday released the following statement regarding a report by The Markup, an investigative journalism group, on its “flawed analysis” of mortgage lending:

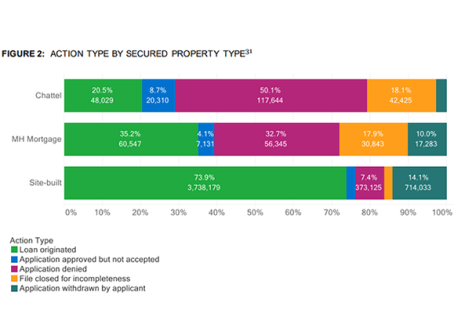

CFPB: Manufactured Housing Loan Borrowers Face Higher Interest Rates, Risks, Barriers to Credit

The Consumer Financial Protection Bureau said manufactured housing can be an affordable but potentially risky avenue for homeownership.

MBA: 2019 Multifamily Lending Up 7% to Record High

Fueled by strong market fundamentals and low interest rates, 2,589 different multifamily lenders provided $364.4 billion in new mortgages in 2019 for apartment buildings with five or more units, according to the Mortgage Bankers Association’s 2019 Multifamily Lending Report.

CFPB Issues Interpretive Rule on Determining Underserved Areas; Final Rule on Loss Mitigation Options for Homeowners with COVID-Related Hardships

The Consumer Financial Protection Bureau issued an interpretive rule to provide guidance to creditors and other persons involved in the mortgage origination process about the way in which the Bureau determines which counties qualify as “underserved” for a given calendar year.

CFPB Issues Final Rule Raising HMDA Data Reporting Thresholds

The Consumer Financial Protection Bureau last week issued a final rule raising loan-volume coverage thresholds for financial institutions reporting data under the Home Mortgage Reporting Act.

CoreLogic: With QM GSE ‘Patch’ Set to Expire, Impact Warrants Closer Investigation

In two blog posts last week, CoreLogic, Irvine, Calif., examined the relationship between loan pricing and loan performance in context of the coming expiration of the Consumer Financial Protection Bureau’s Qualified Mortgage “GSE Patch.” The blogs noted little distinction in loan delinquencies in certain rate spread categories, but noted closer investigation is warranted.