More than 12 years after the federal government placed Fannie Mae and Freddie Mac under conservatorship—and seemingly no closer to moving them out of conservatorship—the Mortgage Bankers Association and several industry trade groups urged the Treasury Department to promote “critical reforms” of the GSEs and bolster their safety and soundness.

Tag: Freddie Mac

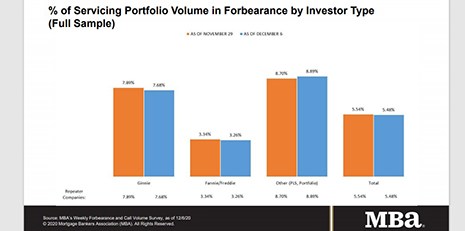

MBA: Share of Mortgage Loans in Forbearance Drops Back to 5.48%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased to 5.48% of servicers’ portfolio volume as of December 6 from 5.54% the prior week. MBA estimates 2.7 million homeowners are in forbearance plans.

CFPB Issues Final Mortgage Rules on General QM, Seasoned QM

The Consumer Financial Protection Bureau on Thursday issued final rules related to qualified mortgage loans. The Mortgage Bankers Association provided preliminary summaries of the final rules.

The Redesigned URLA Is Coming Jan. 1. Are You Ready?

Fannie Mae and Freddie Mac (the GSEs) will ring in the New Year by starting to accept the redesigned Uniform Residential Loan Application (URLA) and updated automated underwriting system (AUS) loan application submission files based on MISMO v3.4. Beginning January 1, 2021, all lenders, aggregators and third-party originators who are ready to send and accept the redesigned URLA may participate in the two-month Open Production Period (OPP), which allows for a gradual transition prior to the March 1, 2021 mandate.

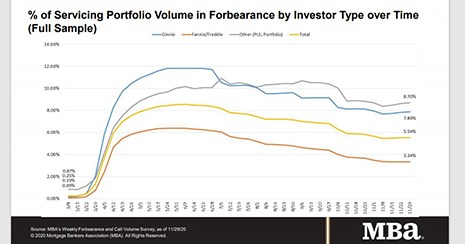

MBA: Share of Loans in Forbearance Flat at 5.54%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance remained unchanged from the prior week at 5.54% as of November 29. MBA estimates 2.8 million homeowners are in forbearance plans.

FHFA Extends Foreclosure and REO Eviction Moratoria through Jan. 31

The Federal Housing Finance Agency said Fannie Mae and Freddie Mac will extend the moratoriums on single-family foreclosures and real estate owned (REO) evictions until at least January 31, 2021.

FHFA Holds 2021 Deemed-Issuance Ratio for UMBS at 60/40

The Federal Housing Finance Agency announced the deemed-issuance ratio for the 2021 calendar year in accordance with Internal Revenue Service guidelines on trading of the Uniform Mortgage-Backed Security will remain unchanged in 2021 at 60 percent Fannie Mae and 40 percent Freddie Mac.

The Wonder Years: Freddie Mac’s K Series Turns 11

Freddie Mac’s K series quietly holds a place as an important, innovative multifamily market solution that has served borrowers, lenders, tenants and bondholders extremely well since its inception. Importantly for a government-sponsored entity, it also serves as a mechanism to transfer risk away from taxpayers.

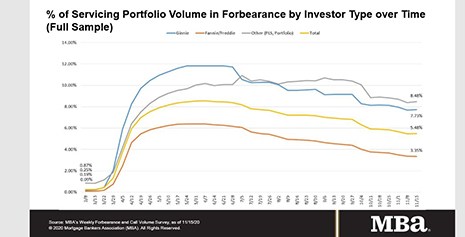

MBA: Share of Mortgage Loans in Forbearance Edges Up to 5.48%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance increased to 5.48% of mortgage servicers’ portfolio volume as of November 15, from 5.47% the week before. MBA estimates 2.7 million homeowners are in forbearance plans.

FHFA Sets Final Rule for GSE Regulatory Capital Framework

The Federal Housing Finance Agency on Nov. 18 released a final rule that establishes a new regulatory capital framework for Fannie Mae and Freddie Mac.