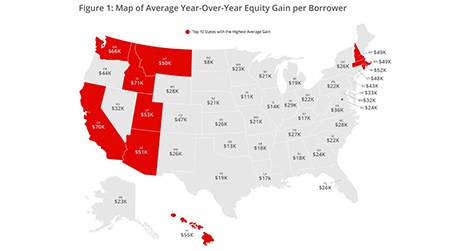

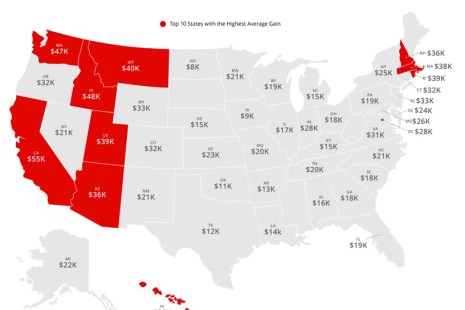

Corelogic, Irvine, Calif., said “underwater” (negative equity) homes decreased by 24% year over year in the first quarter, while the average homeowner gained $33,400 in equity year over year.

Tag: Frank Nothaft

CoreLogic: Strong Improvement in U.S. Mortgage Delinquency Rates

CoreLogic, Irvine, Calif., said just 4.9 percent of all mortgages in the U.S. were in some stage of delinquency, the lowest rate in more than a year.

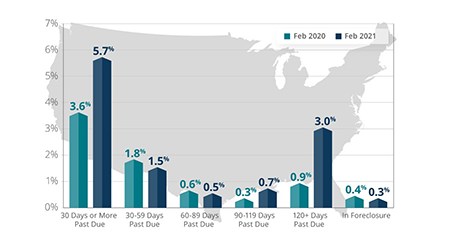

CoreLogic: Mortgage Delinquency Rates Level Off in February

Despite a small uptick in overall delinquencies, serious delinquencies continued to decrease, CoreLogic, Irvine, Calif., reported this morning.

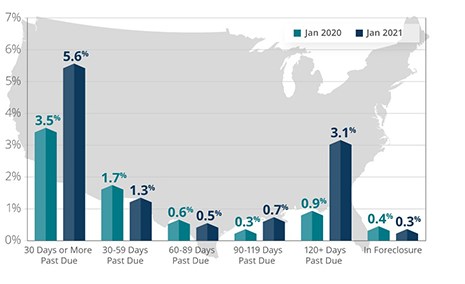

CoreLogic: Annual Mortgage Delinquency Rate Drops for 5th Straight Month to 10-Month Low

CoreLogic, Irvine, Calif., said while mortgage delinquencies rose month over month in January, overall delinquency rates fell for the fifth straight month to the lowest level since last March.

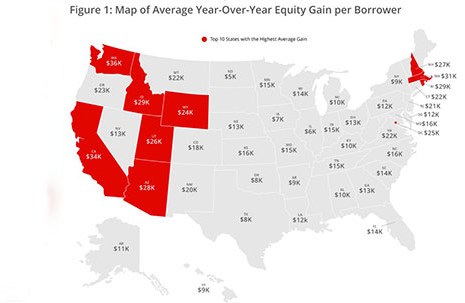

Home Equity Continues to Soar: Homeowners Gained $1.5 Trillion in 2020

CoreLogic, Irvine, Calif., said U.S. homeowners with mortgages saw their equity increase by 16.2% year over year, representing a collective equity gain of more than $1.5 trillion, and an average gain of $26,300 per homeowner, from a year ago.

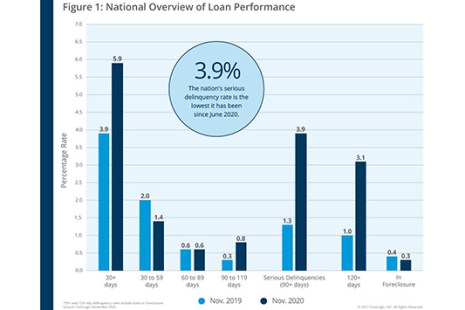

CoreLogic: November Mortgage Delinquency Rates at 11-Month Low

CoreLogic, Irvine, Calif., said new November mortgage delinquencies fell below pre-pandemic levels and, while serious delinquencies fell to their lowest levels since June.

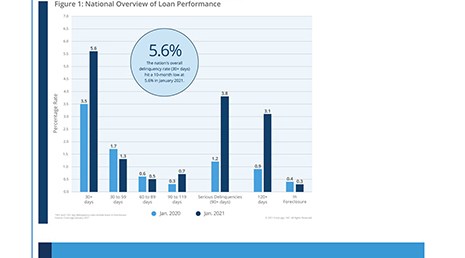

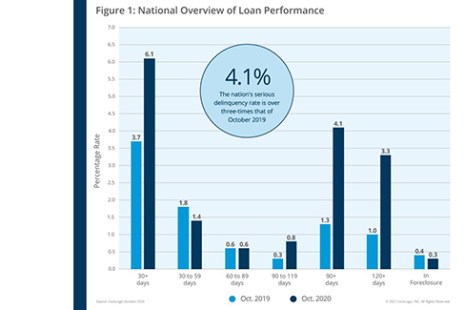

CoreLogic: Mortgage Delinquencies Rise, But Pace Moderates

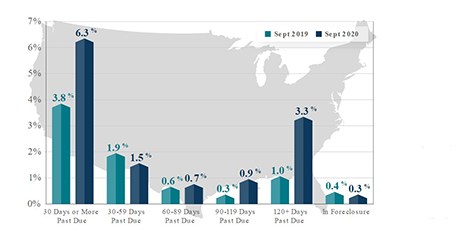

CoreLogic, Irvine, Calif., said on a national level, 6.1% of mortgages were in some stage of delinquency (30 days or more past due, including those in foreclosure) in October, a 2.4-percentage point increase from a year ago, when it was 3.7%.

Home Equity Reaches Record High: Homeowners Gained $1 Trillion in 3Q Equity

CoreLogic, Irvine, Calif., said U.S. homeowners with mortgages saw their equity increase by 10.8% year over year in the third quarter—a collective equity gain of $1 trillion and an average gain of $17,000 per homeowner.

CoreLogic: Serious Delinquencies Level Off in ‘Positive Signal’

CoreLogic, Irvine, Calif., said its monthly Loan Performance Insights Report for September showed a leveling off of serious loan delinquencies, a “positive signal” that the housing finance industry is thus far adjusting to the pandemic-induced economic downturn.

CoreLogic: Foreclosures Remain Low; Serious Delinquencies Continue to Build Up

Ahead of this morning’s quarterly National Delinquency Survey from the Mortgage Bankers Association, CoreLogic, Irvine, Calif., said the 150-day delinquency rate reached its highest level since January 1999, noting that forbearance provisions have helped foreclosure rates maintain historic lows.