Homeowners Add $1.9 Trillion in 1Q Equity

Corelogic, Irvine, Calif., said “underwater” (negative equity) homes decreased by 24% year over year in the first quarter, while the average homeowner gained $33,400 in equity year over year.

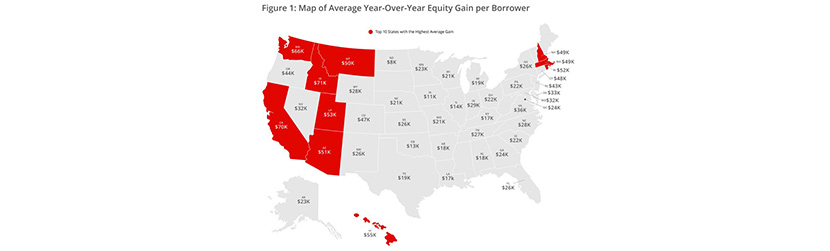

The company’s quarterly Homeowner Equity Report said U.S. homeowners with mortgages (representing 62% of all properties) saw their equity increase by 19.6% year over year, representing a collective equity gain of more than $1.9 trillion, and an average gain of $33,400 per borrower, since first quarter 2020.

The report said while the coronavirus pandemic created economic uncertainty for many, continued acceleration in home prices over the last year meant existing homeowners saw a notable boost in home equity.

CoreLogic Chief Economist Frank Nothaft said accumulation of equity has become critically important to homeowners deciding on their post-forbearance options. He noted in contrast to the financial crisis, when many borrowers were underwater, borrowers today who are behind on mortgage payments can tap into their equity and sell their home rather than lose it through foreclosure.

“Double-digit home price growth in the past year has bolstered home equity to a record amount,” Nothaft said. “The national CoreLogic Home Price Index recorded an 11.4% rise in the year through March 2021, leading to a $216,000 increase in the average amount of equity held by homeowners with a mortgage. This reduces the likelihood for a large numbers of distressed sales of homeowners to emerge from forbearance later in the year.”

The report said from the fourth quarter mortgaged homes in negative equity decreased by 7% to 1.4 million homes, or 2.6% of all mortgaged properties. From a year ago, 1.8 million homes, or 3.4% of all mortgaged properties, were in negative equity. This number decreased by 24%, or 450,000 properties, in the first quarter.

The report said the national aggregate value of negative equity fell to $273 billion at the end of the first quarter, down by $8.1 billion, or 2.9%, from $281.1 billion in the fourth quarter and down by $13.3 billion, or 4.6%, from $286.3 billion a year ago.

The report said should home prices increase by 5%, 195,000 homes would regain equity in the second quarter; if home prices decline by 5%, 260,000 would fall underwater.

“Homeowner equity has more than doubled over the past decade and become a crucial buffer for many weathering the challenges of the pandemic,” said Frank Martell, president and CEO of CoreLogic. “These gains have become an important financial tool and boosted consumer confidence in the U.S. housing market, especially for older homeowners and baby boomers who’ve experienced years of price appreciation.”