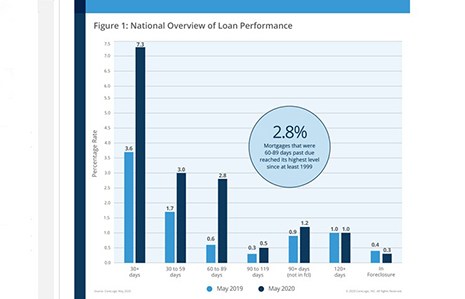

Ahead of this week’s 2nd Quarter National Delinquency Survey from the Mortgage Bankers Association, CoreLogic, Irvine, Calif., said early-stage and adverse mortgage delinquency rates increased for the second consecutive month, with all 50 states and more than 75% of U.S. metro areas seeing increases in overall delinquency rates.

Tag: Frank Martell

CoreLogic: Mortgage Delinquencies Hit Downslope

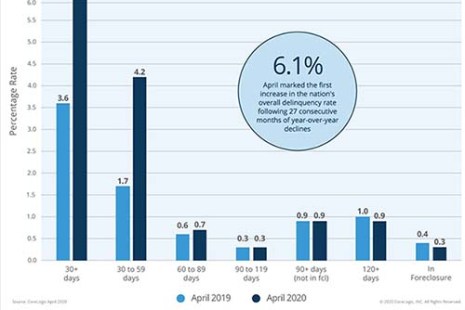

CoreLogic, Irvine, Calif., said April early stage mortgage delinquencies jumped to levels that exceeded even those during the Great Recession.

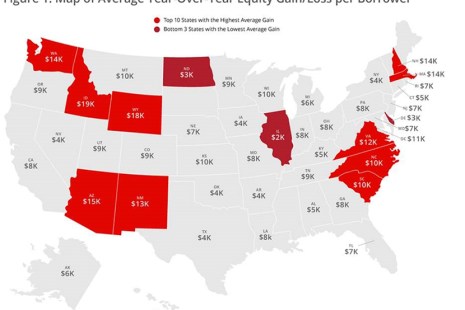

CoreLogic: Borrowers Gain $6 Trillion in Home Equity Since End of Great Recession

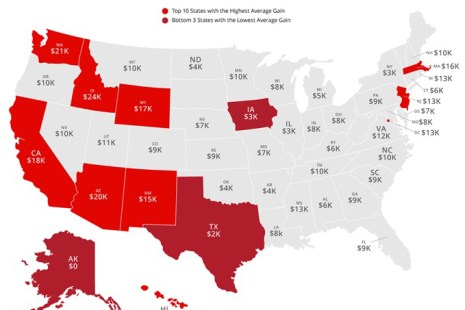

CoreLogic, Irvine, Calif., said U.S. homeowners with mortgages—representing 63% of all properties—have seen their equity increase by 6.5% year over year, representing a gain of $590 billion since 2019.

CoreLogic: Delinquencies Stay Low Despite Pandemic Impact

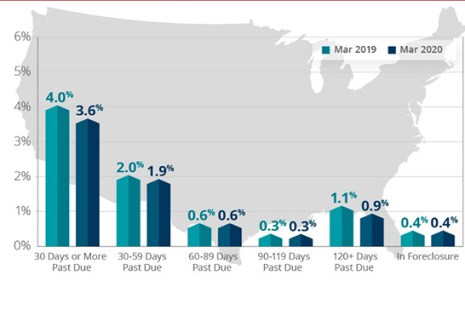

CoreLogic, Irvine, Calif., said its analysis of March mortgage delinquencies and foreclosures found despite the early impact of the coronavirus pandemic, delinquencies remained relatively low.

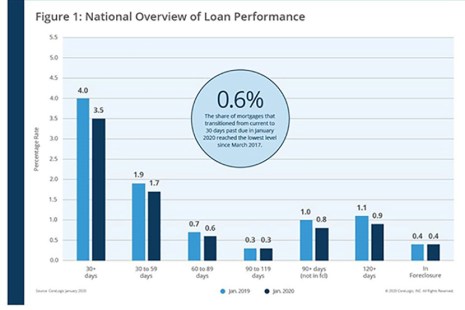

CoreLogic: Annual Delinquency Rates Fall for 25th Consecutive Month

CoreLogic, Irvine, Calif., reported 3.5% of mortgages in some stage of delinquency in January, an 0.5 percentage point decline in the overall delinquency rate from a year ago.

Nearly 100,000 Homeowners Regained Positive Equity in Fourth Quarter

CoreLogic, Irvine, Calif., said the number of Americans with negative equity in their homes fell to the lowest level since before the Great Recession, with 96,000 homeowners regaining equity in the fourth quarter.

CoreLogic: December U.S. Delinquency Rate Lowest in 20 Years

CoreLogic, Irvine, Calif., reported just 3.7% of mortgages in some stage of delinquency in December, the lowest for a December in more than 20 years.

CoreLogic: October Delinquency Rate Hits 20-Year Low

CoreLogic, Irvine, Calif., reported 3.7% of mortgages were in some stage of delinquency in October, an 0.4 percentage point decline from a year ago.

CoreLogic: 78,000 Single-Family Properties Regained Equity in 3Q

CoreLogic, Irvine, Calif., said U.S. homeowners with mortgages–representing 64% of all properties–saw their equity increase by 5.1% year over year in the third quarter, a gain of nearly $457 billion from a year ago.

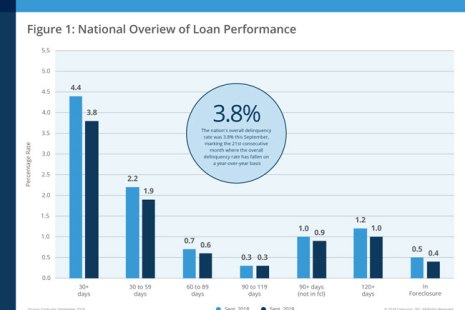

CoreLogic: September Mortgage Delinquency Rate Lowest in 20 Years

CoreLogic, Irvine, Calif., released its monthly Loan Performance Insights Report, showing 3.8% of mortgages were in some stage of delinquency in September, an 0.6 percentage point decline from a year ago.