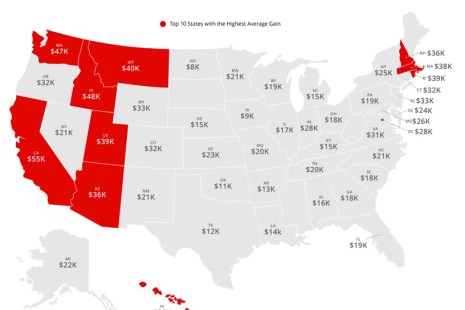

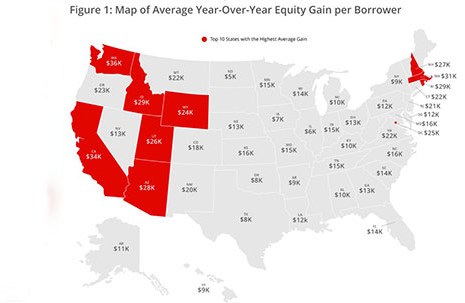

CoreLogic, Irvine, Calif., said U.S. homeowners with mortgages saw their equity increase by 16.2% year over year, representing a collective equity gain of more than $1.5 trillion, and an average gain of $26,300 per homeowner, from a year ago.

Tag: Frank Martell

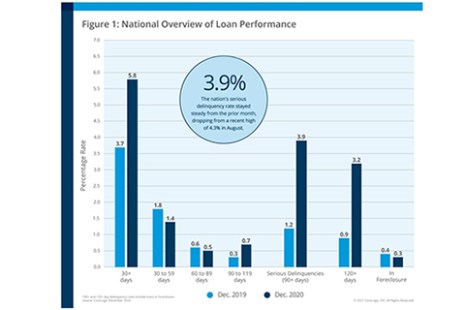

2020 Mortgage Delinquencies See Record Highs—and Record Lows

CoreLogic, Irvine, Calif., said its year-end Loan Performance Insights Report showed overall mortgage delinquency rates fell for the fourth straight month in December, ending a volatile year with signs of recovery.

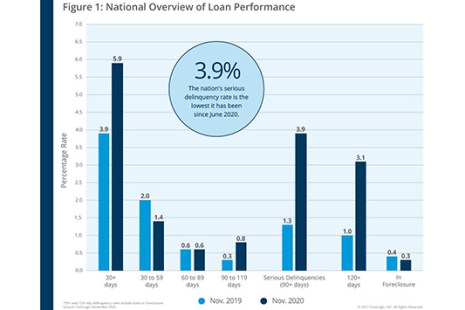

CoreLogic: November Mortgage Delinquency Rates at 11-Month Low

CoreLogic, Irvine, Calif., said new November mortgage delinquencies fell below pre-pandemic levels and, while serious delinquencies fell to their lowest levels since June.

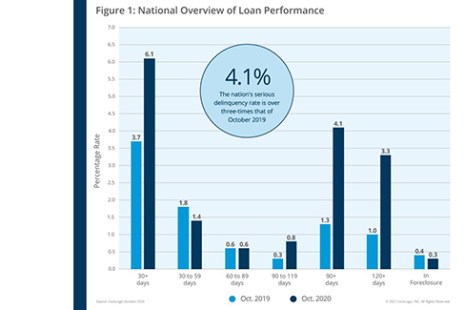

CoreLogic: Mortgage Delinquencies Rise, But Pace Moderates

CoreLogic, Irvine, Calif., said on a national level, 6.1% of mortgages were in some stage of delinquency (30 days or more past due, including those in foreclosure) in October, a 2.4-percentage point increase from a year ago, when it was 3.7%.

Home Equity Reaches Record High: Homeowners Gained $1 Trillion in 3Q Equity

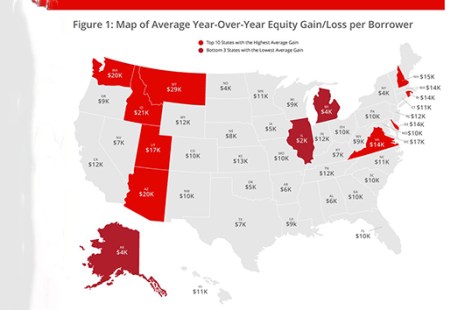

CoreLogic, Irvine, Calif., said U.S. homeowners with mortgages saw their equity increase by 10.8% year over year in the third quarter—a collective equity gain of $1 trillion and an average gain of $17,000 per homeowner.

CoreLogic: Serious Delinquencies Level Off in ‘Positive Signal’

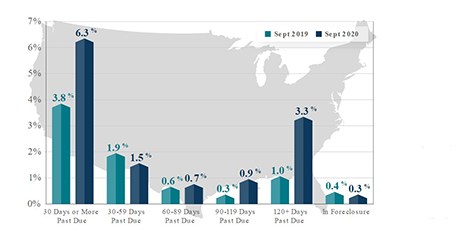

CoreLogic, Irvine, Calif., said its monthly Loan Performance Insights Report for September showed a leveling off of serious loan delinquencies, a “positive signal” that the housing finance industry is thus far adjusting to the pandemic-induced economic downturn.

CoreLogic: Foreclosures Remain Low; Serious Delinquencies Continue to Build Up

Ahead of this morning’s quarterly National Delinquency Survey from the Mortgage Bankers Association, CoreLogic, Irvine, Calif., said the 150-day delinquency rate reached its highest level since January 1999, noting that forbearance provisions have helped foreclosure rates maintain historic lows.

Home Price Appreciation Jumps to Six-Year High

CoreLogic, Irvine, Calif., said home prices increased 6.7% nationally in September from a year ago, the fastest annual acceleration since May 2014.

CoreLogic: Serious Delinquencies Spiking Despite Strong Housing Demand

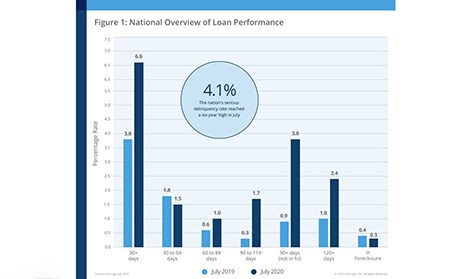

CoreLogic, Irvine, Calif., reported an increase in overall mortgage delinquency rates in July—and in particular, a spike in serious delinquencies to their highest level in more than six years.

CoreLogic: Despite Pandemic, Homeowners Gain $620 Billion in Equity

CoreLogic, Irvine, Calif., said its 2nd Quarter Home Equity Report shows U.S. homeowners with mortgages—which account for 63% of all properties—have seen their equity increase by 6.6% year over year. This represents a collective equity gain of $620 billion and an average gain of $9,800 per homeowner from a year ago.