Fitch Ratings, New York, said potential stress on U.S. life insurers’ commercial mortgage portfolios will not drive rating downgrades, given the industry’s strong capitalization, current loan quality and historical loss experience.

Tag: Fitch Ratings

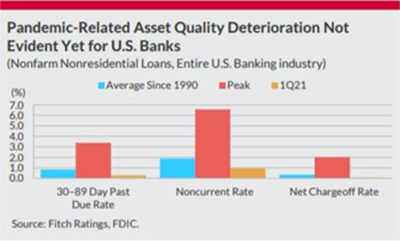

Fitch Ratings: Small U.S. Banks Most Exposed to Commercial Real Estate Losses

Fitch Ratings, Chicago, said the U.S. commercial real estate market will likely see deteriorating credit metrics once stimulus measures wind down and forbearance programs expire, with smaller CRE-concentrated banks more susceptible to elevated losses, which are expected to peak below levels seen in the past.

Most Senior CMBS Found ‘Resilient’ Under Stress Test

Most high investment-grade rated commercial mortgage-backed securities multi-borrower bonds can withstand downgrades under a new hypothetical stress test, Fitch Ratings reported last week.

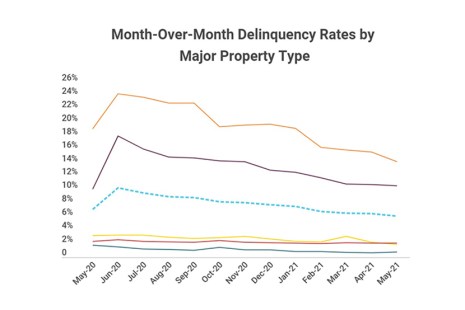

CMBS Delinquency Rate Improvement Reaches 11-Month Mark

Trepp LLC, New York, reported the commercial mortgage-backed securities delinquency rate declined again in May, posting its biggest drop in three months.

Fitch: Risks to Affordable Multifamily Housing Remain Despite Stimulus

Fitch Ratings, New York, said rental assistance provided under the American Rescue Plan will help renters and multifamily property landlords, but the extent to which the ARP can keep delinquencies low is uncertain, as the amount of unpaid back rent is difficult to estimate due to lack of data.

CMBS Delinquency Rate Drops 8th Straight Month

In February, the commercial mortgage-backed securities delinquency rate saw its largest improvement since the pandemic started last year, reported Trepp, New York.

Fitch Ratings: Solid U.S. RMBS Market Faces Uncertainty

Fitch Rating, New York, said the new-issue private-label U.S. residential mortgage-backed securities market is humming along at a solid pace, though it says some broader developments in the coming year could influence the pace of new deals.

CMBS Delinquency Rate Declines for Third Straight Month

Fitch Ratings, New York, reported the U.S. commercial mortgage-backed securities delinquency rate fell 14 basis points in January to 4.55 percent due to a slowing pace of new delinquencies and strong new issuance.

Low Rates Driving CMBS Defeasance Trend

Fitch Ratings, New York, said commercial mortgage-backed securities borrowers are taking advantage of the current low interest rate environment to defease their loans.

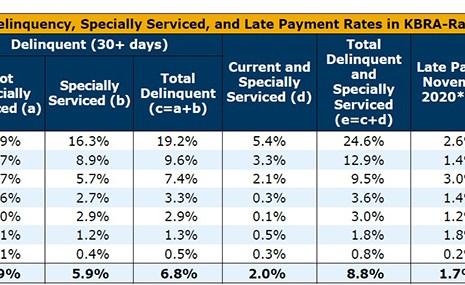

CMBS Delinquency Rate Dips

The commercial mortgage-backed securities delinquency rate dipped in November, largely due to continued Coronavirus debt relief, said Fitch Ratings, New York.