Fitch Ratings, New York, said underwriting results for U.S. mortgage insurers remained very strong through 2023.

Tag: Fitch Ratings

Fitch Says Weaker Collateral for Non-QM/Non-Prime 2023 RMBS Leads to Elevated Delinquency Rate

Fitch Ratings, New York, said delinquencies for non-QM 2023-vintage RMBS transactions are higher than the 2022 vintage, reflection weaker collateral attributes.

Fitch: 2024 Outlook for Mortgage Insurers Revised to Neutral

Fitch Ratings, New York, has revised its 2024 sector outlook for U.S. mortgage insurers to neutral. Previously the outlook had it at deteriorating.

Fitch Ratings: Life Insurers Can Withstand Commercial Real Estate Deterioration

Fitch Ratings, New York, said U.S. life insurers’ ratings are not currently at risk from commercial real estate exposure, due to insurers’ stable investment portfolios, conservative underwriting, strong liquidity and effective asset-liability management.

Fitch: Office Property Performance to Worsen Amid Rising Market Pressures

Office loan performance will likely continue to weaken as market pressures build, reported Fitch Ratings, New York.

Fitch Ratings: Non-Bank Mortgage Lenders to Withstand Liquidity, Funding Pressures

U.S. non-bank mortgage companies are positioned to withstand liquidity and funding pressures amid the fallout from recent bank failures, growing recessionary risks and tightening lending standards, reported Fitch Ratings, New York.

Fitch: RMBS Servicers Focus on Struggling Borrowers; Delinquencies Remain Flat

Servicers continued to work with struggling homeowners to avoid loan default as delinquent loans remained flat in late 2022, according to Fitch Ratings’ fourth-quarter U.S. RMBS Servicer Metric Report.

Industry Briefs: FHFA Requests Input on GSEs’ Single-Family Pricing Framework

The Federal Housing Finance Agency issued a Request for Input on Fannie Mae and Freddie Mac’s single-family pricing framework. The RFI solicits public feedback on goals and policy priorities that FHFA should pursue in its oversight of the pricing framework.

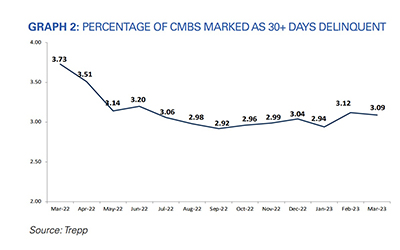

CMBS Delinquency Rate Dips; Offices See Increase

The commercial mortgage-backed securities delinquency rate fell slightly in March, but the segment that everyone watches closely–office–saw its rate move higher again, reported Trepp, New York.

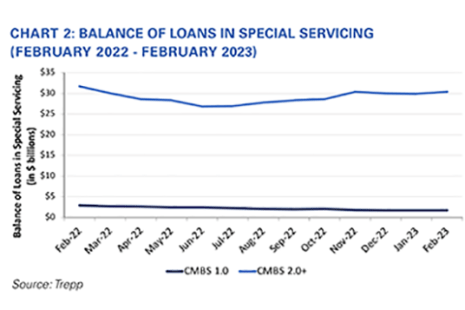

CMBS Delinquency Rate Dips; Special Servicing Rate Increases

Fitch Ratings, New York, reported the commercial mortgage-backed securities delinquency rate decreased two basis points in February to 1.83%.