Fitch Ratings, New York, said regulatory scrutiny of servicing practices at U.S. mortgage companies is expected to increase in 2022 as pandemic-related government forbearance programs expire and borrowers transition into other permanent loss mitigation alternatives or default.

Tag: Fitch Ratings

Fitch: Some REITs Struggle with Coronavirus Effects

Fitch Ratings, New York, reported 17 percent of U.S. equity real estate investment trusts had negative outlooks in December, down significantly from a year ago.

CMBS Delinquency, Special Servicing Rates Dip in December

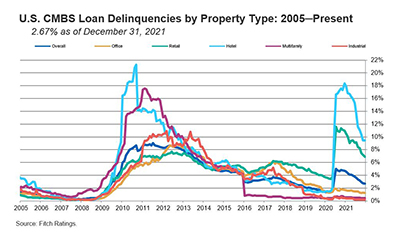

Fitch Ratings, New York, said the commercial mortgage-backed securities delinquency rate dipped nine basis points in December to 2.67 percent, driven by robust new issuance, continued loan resolutions and fewer new delinquencies.

CMBS Delinquency, Special Servicing Rates Fall

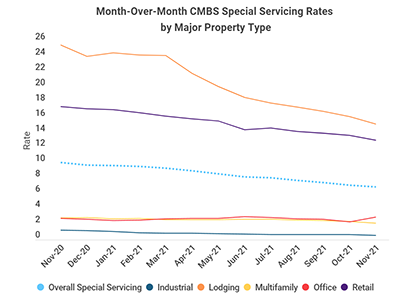

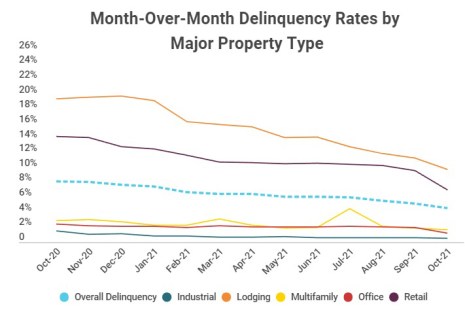

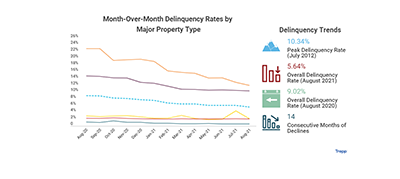

Trepp, New York, reported both the commercial mortgage-backed securities delinquency rate and special servicing rate dropped in November.

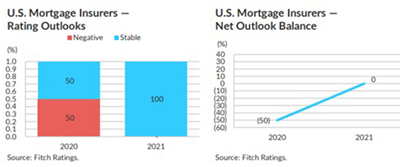

Fitch: Mortgage Insurers See Consistent Losses, Market Stability in 2022

Fitch Ratings, Chicago, said the operating environment for U.S. mortgage insurers is expected to remain steady in 2022, as economic indicators have generally improved since the low point of the pandemic, with lower than expected losses from the pandemic fallout and continued home price appreciation supportive of credit fundamentals of the rated peer group of private MIs.

Fitch: REITs Can Withstand Short-Term Inflation Pressures

Fitch Ratings, New York, said it sees limited risks to real estate investment trust credit fundamentals from a transitory inflation-rate increase, but noted prolonged elevated inflation could pressure REITs.

CMBS Delinquency Rate Tumbles

Trepp LLC, New York, reported the commercial mortgage-backed securities delinquency rate declined sharply again in October.

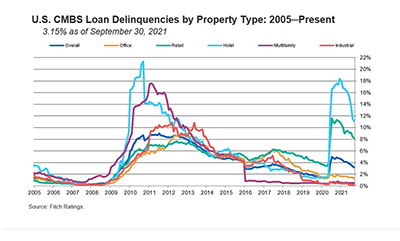

September CMBS Delinquency, Special Servicing Rates Drop

Fitch Ratings, New York, and Trepp LLC, New York, reported the commercial mortgage-backed securities delinquency rate continued it steady fall in September.

CMBS Delinquency Rate Shrinks, Cumulative Default Rate Increases

The commercial mortgage-backed securities delinquency rate continues to shrink, but the cumulative loan default rate increased slightly in first-half 2021, according to two new reports from S&P Global Ratings and Fitch Ratings.

CMBS Delinquency Rate Drops Sharply

The commercial mortgage-backed securities delinquency rate declined sharply in August, posting the largest drop in six months, reported Trepp LLC, New York.