Ahead of a scheduled vote this week, the Mortgage Bankers Association asked the House Appropriations Committee to support key fiscal year 2022 appropriations proposed to HUD, FHA and Ginnie Mae.

Tag: FHA

MBA Letter Urges Senate Support of Julia Gordon Nomination as FHA Commissioner

The Mortgage Bankers Association urged the Senate Banking Committee to quickly approve Julia Gordon’s nomination as FHA Commissioner and forward her nomination for a full Senate vote.

Biden Administration Nominates Julia Gordon as FHA Commissioner; Dave Uejio as HUD Assistant Secretary

The Biden Administration on Friday nominated Julia Gordon as FHA Commissioner and announced Dave Uejio, who has been serving as Acting Director of the Consumer Financial Protection Bureau, has been nominated as HUD Assistant Secretary for Fair Housing and Equal Opportunity.

MBA Statement on Changes to FHA’s Calculation of Student Debt

Statement by MBA President and CEO Bob Broeksmit, CMB, regarding the announced changes to FHA’s calculation of student debt:

HUD Extends FHA Foreclosure/Eviction Moratorium through Mar. 31

HUD on Jan. 21 extended the moratorium on FHA single-family foreclosures and evictions through Mar. 31.

FHA to Permit DACA-Status Recipients to Apply for FHA-Insured Mortgages

HUD said Jan. 20 it will permit individuals classified under the “Deferred Action for Childhood Arrivals” program (DACA) with the U.S. Citizenship & Immigration Service and are legally permitted to work in the U.S. to apply for mortgages backed by FHA.

FHA Follows Suit, Raises Single-Family Loan Limits for 2021

As expected, the Federal Housing Administration matched Fannie Mae and Freddie Mac in its single-family and Home Equity Conversion Mortgage insurance programs for 2021.

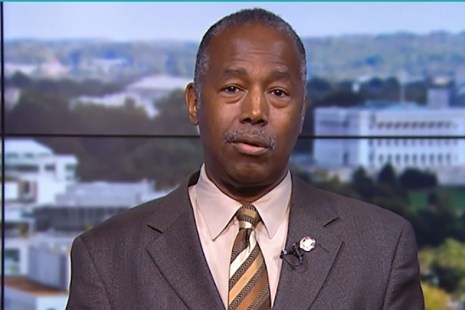

Carson: FHA Will Extend Forbearance Requests Through Year-End

HUD Secretary Ben Carson announced the Federal Housing Administration will extend the date for single-family homeowners with FHA-insured mortgages to request an initial forbearance from their mortgage servicer for up to six months.

GSEs, FHA Extend Foreclosure/REO Eviction Moratoria

The government-sponsored enterprises and HUD announced they would extend foreclosure moratoria to all GSE-backed mortgages and FHA-backed mortgages, respectively and extend eviction moratoria through at least Dec. 31.

MBA, Trade Groups Ask FHA To Revise Borrowers’ Student Loan Debt Treatment

The Mortgage Bankers Association and 18 other groups asked the Federal Housing Administration to revise its treatment of borrowers’ student loan debt to better align with the standards at the GSEs, VA and USDA.