MBA President and CEO Bob Broeksmit, CMB, provides his perspective on the latest proposed capital requirement developments and their effects on the industry.

Tag: Federal Reserve

MBA, Housing Trades Call on Fed to End Rate Hikes, Pledge Not to Sell MBS Book

Yesterday, the Mortgage Bankers Association led a coalition letter sent to the Board of Governors of the Federal Reserve that conveyed the housing industry’s serious concerns about the negative market impacts the Fed’s monetary policy actions (e.g., rate hikes and quantitative tightening) are having on the market.

Fed Keeps Rates Steady But Options Open

The Federal Open Market Committee held rates steady at its June meeting but kept its options open for July and later this year.

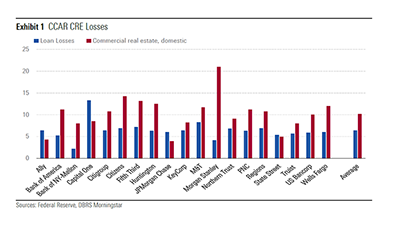

DBRS Morningstar: Federal Reserve Finds CRE Risk

The good news: all 34 banks the Federal Reserve’s recent stress tests examined passed. The not-so-good news: the tests found potential risks in certain loan portfolios including commercial real estate, said DBRS Morningstar, New York.

MBA Letter to Agencies Targets Topline CRA Issues

The Mortgage Bankers Association last week sent a letter to federal regulatory agencies, discussing several topline issues it says are crucial to improving the current Community Reinvestment Act framework.

Federal Reserve Board: Household Financial Well-Being Improves

U.S. household financial well-being improved in 2021, the Federal Reserve Board said Monday.

MBA Letter Offers Recommendations on Improving CRA Framework

The Mortgage Bankers Association, in a letter last week to the Federal Reserve, offered recommendations on how the Fed could improve the Community Reinvestment Act to improve credit access and more effectively meet the needs of low- and moderate-income communities.

Federal Agencies Propose Regulation Codifying Use of Supervisory Guidance

Five federal agencies last week issued a proposed regulation that would codify a 2018 guidance clarifying that supervisory guidance does not have “force and effect of law.”

Andrew Foster: Preferred Equity Plan for Commercial Real Estate Comes to Washington

Here in Washington, ongoing COVID-19 relief discussions have reached the commercial real estate borrowing community and their financiers in earnest.

Tom Lamalfa: May 2020 Survey of Secondary Market Executives

What follows are findings from a survey of senior mortgage executives I conducted in the first half of May. Due to cancellation of MBA’s National Secondary Market Conference, this survey was completed over the phone rather than face to face, as has been the case in the 23 preceding surveys done since 2008. Normally the surveys are conducted at the secondary conference as well as at the MBA Annual Convention every October.