The multifamily sector made it through the first half of the year with less turmoil as some anticipated. But the pandemic could create longer-term challenges for the sector, said Phoenix American, San Rafael, Calif.

Tag: Fannie Mae

MBA: Loans in Forbearance Fall 9th Straight Week

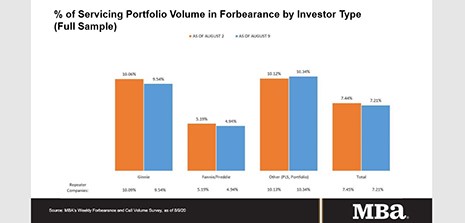

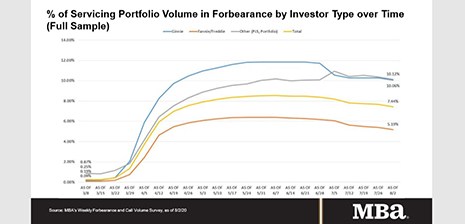

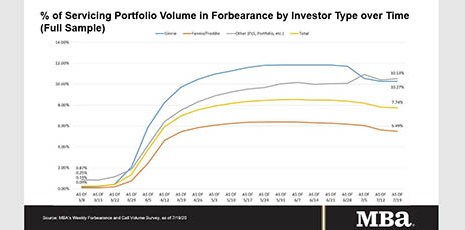

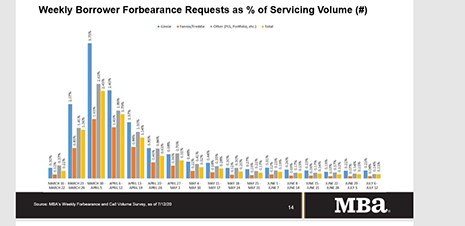

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 23 basis points to 7.21% of servicers’ portfolio volume the week of Aug. 9 from 7.44% the previous week. MBA estimates 3.6 million homeowners are in forbearance plans.

MBA, Trade Groups Issue Joint Statement on GSE Adverse Market Fee

The Mortgage Bankers Association Thursday joined a broad coalition of organizations representing the housing, financial services industries as well as public interest groups issued the following statement on the GSEs’ new adverse market fee.

MBA Mortgage Action Alliance ‘Call to Action’ Targets GSE Refi Fee

In the wake of new directive by Fannie Mae and Freddie Mac to impose a 50 basis point “Adverse Market Refinance Fee” on most refinance mortgages, effective Sept. 1, the Mortgage Bankers Association’s grassroots advocacy arm, the Mortgage Action Alliance, issued a ‘Call to Action’ urging its 50,000 members to contact their members of Congress and the Federal Housing Finance Agency to roll back the directive.

FHFA Extends Temporary Policy Allowing Purchase of Qualified Loans in Forbearance to Aug. 31

The Federal Housing Finance Agency approved an extension of the temporary policy that allows for the purchase of certain single-family mortgages in forbearance that meet specific eligibility criteria set by Fannie Mae and Freddie Mac. The policy is extended for loans originated through August 31.

FHFA: Multifamily Owners in Forbearance Must Inform Tenants of Eviction Suspension, Tenant Protections

The Federal Housing Finance Agency announced Thursday multifamily property owners with mortgages backed by Fannie Mae or Freddie Mac who enter into a forbearance agreement must inform their tenants about protections during the property owner’s forbearance and repayment periods.

MBA: Share of Mortgage Loans in Forbearance Decreases for 8th Straight Week

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans in forbearance decreased by 23 basis points to 7.44% of mortgage servicers’ portfolio volume as of Aug. 2, down from 7.67% of servicers’ portfolio volume the prior week. MBA estimates 3.7 million homeowners are in forbearance plans.

MBA: Share of Loans in Forbearance Falls for 6th Straight Week

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans in forbearance decreased by 6 basis points to 7.74% of servicers’ volume as of July 19, from 7.80% the prior week. MBA now estimates 3.9 million homeowners are in forbearance plans.

FHFA Leaves 2021 GSE Housing Goals Unchanged

With current housing goals set to expire in December, and amid economic uncertainty stemming from the lingering coronavirus pandemic, the Federal Housing Finance Agency yesterday left 2021 housing goals for Fannie Mae and Freddie Mac unchanged from the previous three years.

Share of Mortgage Loans in Forbearance Falls for Fifth Straight Week

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans in forbearance decreased by 38 basis points to 7.80% of mortgage servicers’ portfolio volume as of July 12, from 8.18% the prior week. MBA estimates 3.9 million homeowners are in forbearance plans.