Black Knight, Jacksonville, Fla., reported the national delinquency rate fell 11 basis points in May to 3.1%, the lowest level it’s hit other than a record of 2.92% in March.

Tag: Delinquency Rates

Black Knight: Foreclosure Starts Pull Back; Delinquencies Edge Higher

Black Knight, Jacksonville, Fla., said foreclosure starts fell in July and remain well below pre-pandemic levels, while early-stage delinquencies edged up.

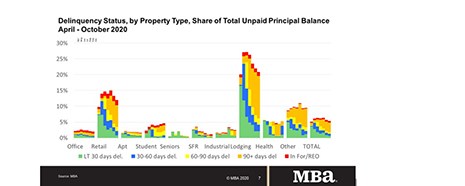

Commercial, Multifamily Delinquencies Decline in October

Delinquency rates for mortgages backed by commercial and multifamily properties declined in October, the Mortgage Bankers Association’s latest monthly CREF Loan Performance Survey reported.

Consumers Resilient Despite Broader Economic Challenges

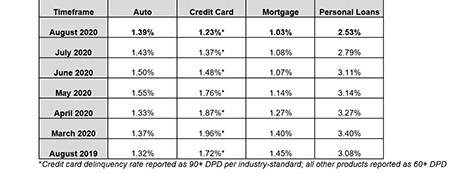

Serious delinquency rates in August improved once more across all consumer credit segments even as the number of people in accommodation programs dropped for the second consecutive month, reported TransUnion, Chicago.

TransUnion: Consumer Credit Market Withstands Coronavirus Challenges

TransUnion, Chicago, reported the total percentage of accounts in “financial hardship” status dropped during July for mortgages, auto loans, credit cards and personal loans – marking the first such decrease since the start of the COVID-19 pandemic.

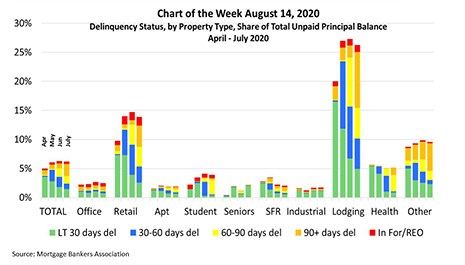

MBA Chart of the Week: Delinquency Rate for Commercial/Multifamily Mortgages

The delinquency rate for commercial and multifamily mortgages declined in July. The rate had increased sharply in April at the onset of the pandemic, with 3.6% of loan balances becoming newly delinquent. In May, delinquencies increased again, with a new, but smaller, cohort of newly delinquent loans.

Black Knight: Mortgage Delinquencies Improve for the First Time Since January; Serious Delinquencies Surge to 9-Year High

Black Knight, Jacksonville, Fla., said after rising from 3.2% in January to 7.8% in May, the national delinquency rate improved for the first time in five months, falling to 7.6% in June as the overall number of past-due mortgages declined by 98,000.

CoreLogic: Serious Delinquency Rates Triple in Recent Disaster Areas

CoreLogic, Irvine, Calif., released its annual Natural Hazard Report, saying communities affected by wildfire, hurricanes, tornadoes, earthquakes and other natural disasters in 2019 will likely experience an increase in mortgage delinquency rates, taking 12 or more months before normalizing to pre-disaster rates.