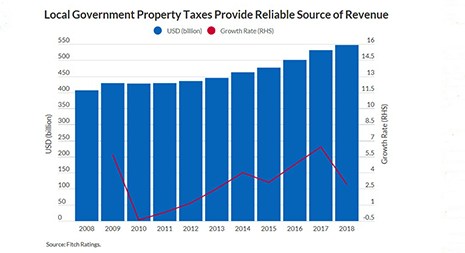

Fitch Ratings, New York, does not expect fiscal 2021 property tax collections to be meaningfully affected by mortgage forbearance programs or delinquencies, but potential for timing delays is “elevated.”

Tag: Coronavirus

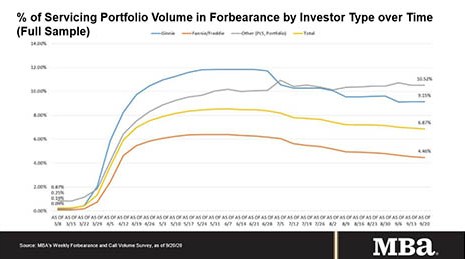

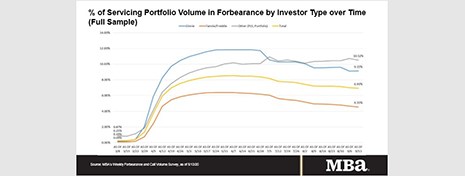

MBA: Share of Loans in Forbearance Drops to 6.87%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 6 basis points to 6.87% of servicers’ portfolio volume as of September 20, from 6.93% the prior week. MBA estimates 3.4 million homeowners remain in forbearance plans.

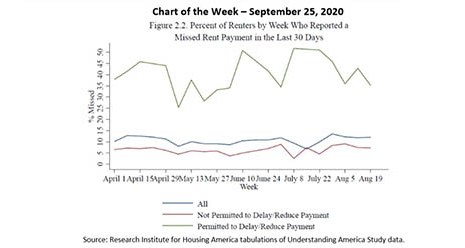

MBA Chart of the Week, Sept. 25, 2020–Missed Rent Payments

On September 17, the Research Institute for Housing America, MBA’s think tank, released a special report on housing-related financial distress during the second quarter – the first three months of the pandemic in the U.S.

Fitch: Secular Shifts Force U.S. Commercial Real Estate to Adapt

Fitch Ratings, New York/London, said post-pandemic, many U.S. commercial real estate segments will be transformed by the way space is used, which will have long-term consequences for property performance and financeability.

Atlanta Fed’s Brian Bailey, CRE, Dishes on Commercial Real Estate Risks

With just under two decades wearing different hats in the commercial real estate industry before joining the bank, Bailey is a CRE subject matter expert in the Atlanta Fed’s Supervision, Regulation and Credit division. In addition to previous roles as an appraiser, consultant and property developer, Bailey holds CCIM and CRE designations. MBS Newslink interviewed Bailey to get his perspective on the current environment.

MBA: Loans in Forbearance Fall to Lowest Level in 5 Months

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey showed loans now in forbearance decreased by 8 basis points to 6.93% of servicers’ portfolio volume as of Sept. 13, compared to 7.01% the week before. MBA estimates 3.5 million homeowners are in forbearance plans.

GSEs: Recession-Era QC Has Lenders Well-Prepared for Current Crisis (MBA LIVE)

Representatives of Fannie Mae and Freddie Mac said lenders thus far have weathered the coronavirus pandemic very well, thanks to lessons learned from the Great Recession.

RIHA Study: COVID-19’s Impact on Jobs, Ability to Make Housing, Student Debt Payments

During the first three months of the COVID-19 pandemic, nearly 11 million households fell behind on their rent or mortgage payments and 30 million individuals missed at least one student loan payment, according to new research released Sept. 17 by the Mortgage Bankers Association’s Research Institute for Housing America.

MBA, Trade Groups Ask Congress to Continue Flood Insurance Program

With the National Flood Insurance Programs set to expire—yet again—the Mortgage Bankers Association and nearly two dozen industry trade groups asked Congress for another program extension as policymakers work on a longer-term solution.

Susan Stewart: COVID-19 Puts Risk Management, QA, Fraud Prevention ‘Front and Center’ (MBA LIVE)

Mortgage Bankers Association Chair-Elect Susan Stewart kicked off the MBA Risk Management, Quality Assurance and Fraud Prevention Forum with an astute observation: the coronavirus pandemic has put such issues “front and center.”