While most will be monitoring increased infections and the progress of vaccine distribution and effectiveness, loan servicing and asset management professionals will have some additional factors impacting their organizations and books of business in the new year.

Tag: Coronavirus

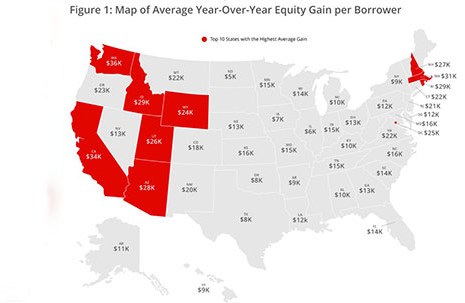

Home Equity Reaches Record High: Homeowners Gained $1 Trillion in 3Q Equity

CoreLogic, Irvine, Calif., said U.S. homeowners with mortgages saw their equity increase by 10.8% year over year in the third quarter—a collective equity gain of $1 trillion and an average gain of $17,000 per homeowner.

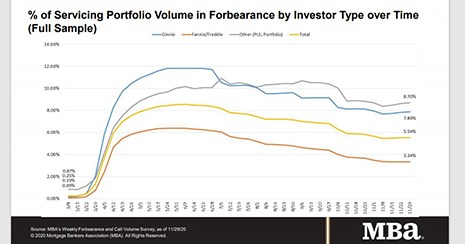

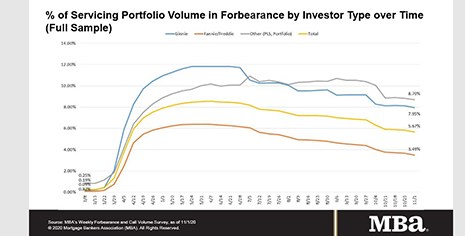

MBA: Share of Loans in Forbearance Flat at 5.54%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance remained unchanged from the prior week at 5.54% as of November 29. MBA estimates 2.8 million homeowners are in forbearance plans.

Dave Parker: Rebounding Non-QM Market Requires Quality Review to Mitigate Risk

The non-QM market is making a recovery and, with continued demand from borrowers, changes to the current QM lending rule and the approaching expiration of the QM patch, is likely to stay on the rebound. As a new range of products come to the market, the question now becomes, how can the mortgage industry ramp up and ensure loan quality for lenders, servicers and investors?

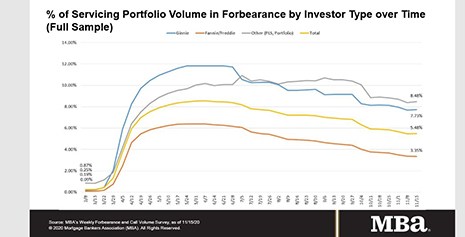

MBA: Share of Mortgage Loans in Forbearance Edges Up to 5.48%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance increased to 5.48% of mortgage servicers’ portfolio volume as of November 15, from 5.47% the week before. MBA estimates 2.7 million homeowners are in forbearance plans.

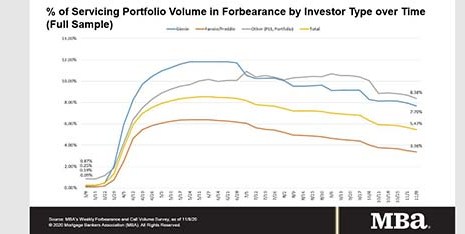

MBA: Share of Mortgage Loans in Forbearance Falls to 5.47%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased for the 11th week in a row, to 5.47% of servicers’ portfolio volume as of Nov. 8 from 5.67% the prior week – a 20-basis-point improvement. MBA now estimates 2.7 million homeowners are in forbearance plans.

‘Not Ok? That’s Ok:’ Financial Services, Consumer Coalition Launches Borrower Awareness Campaign

The Mortgage Bankers Association and a broad coalition of financial services stakeholders – including mortgage servicers, trade associations, housing counseling agencies, governmental agencies and think tanks – launched a consumer awareness campaign to reach borrowers who have missed one or more mortgage payments as a result of the COVID-19 pandemic and may be eligible for forbearance assistance under the CARES Act or other forms of mortgage payment relief.

Broeksmit: ‘MBA Was Made for Times of Crisis’

In remarks yesterday during the Mortgage Bankers Association’s virtual Regulatory Compliance Conference, MBA President & CEO Robert Broeksmit, CMB, said the extraordinary events of 2020 have tested everyone’s mettle—including that of MBA.

MBA: Share of Mortgage Loans in Forbearance Decreases to 5.67%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 16 basis points to 5.67% of servicers’ portfolio volume as of Nov. 1, from 5.83% the prior week. MBA now estimates 2.8 million homeowners are in forbearance plans.

Trevor Gauthier of ACES Quality Management on Early Payment Defaults

Trevor Gauthier is CEO of ACES Quality Management, formerly known as ACES Risk Management (ARMCO). He has more than 20 years of executive experience in leading growth initiatives for tech organizations and building teams both organically and through acquisition.