MBA NewsLink interviewed Dechert Partner Richard Jones. He focuses his practice on sophisticated capital markets and mortgage finance transactions. He leads Dechert’s commercial mortgage-back securities team and serves as co-chair of the firm’s global finance group.

Tag: Coronavirus

Stacey Berger of Midland Loan Services on Servicing Technology

MBA NewsLink recently interviewed Stacey M. Berger, Executive Vice President of Midland Loan Services, Overland Park, Kan.

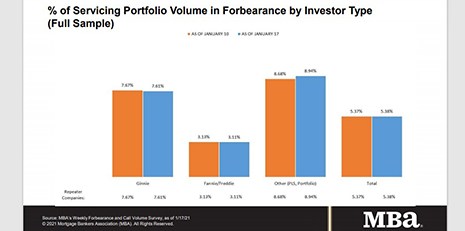

MBA: Share of Mortgage Loans in Forbearance Increases Slightly to 5.38%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance increased slightly to 5.38% of servicers’ portfolio volume as of Jan. 17 from 5.38% the prior week. MBA estimates 2.7 million homeowners are in forbearance plans.

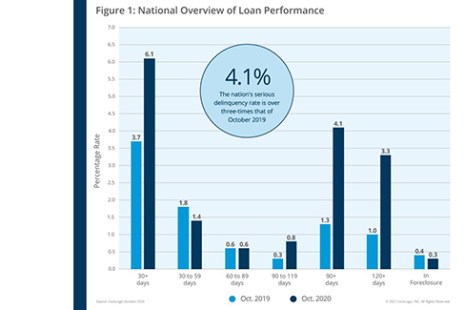

CoreLogic: Mortgage Delinquencies Rise, But Pace Moderates

CoreLogic, Irvine, Calif., said on a national level, 6.1% of mortgages were in some stage of delinquency (30 days or more past due, including those in foreclosure) in October, a 2.4-percentage point increase from a year ago, when it was 3.7%.

Michael Steer: A New Year, A New Regulatory Attitude?

Lenders can adapt the current pandemic regulatory attitude into one that pays equal mind to both the pandemic and the importance of compliance.

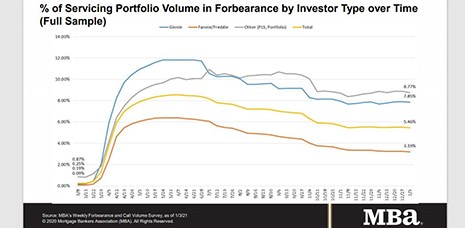

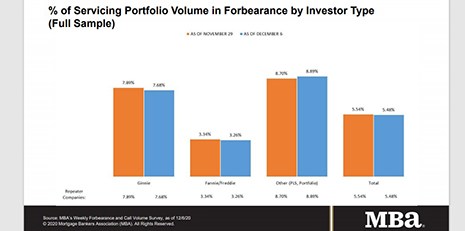

MBA: Share of Loans in Forbearance Drops to 5.46%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased to 5.46% of servicers’ portfolio volume as of Jan. 3 compared to 5.46% the prior week. MBA estimates 2.7 million homeowners are in forbearance plans.

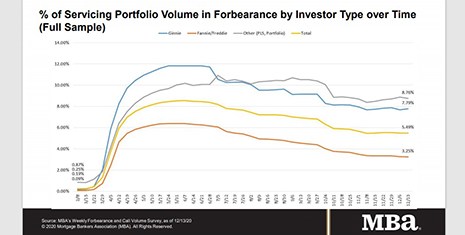

MBA: Share of Mortgages in Forbearance Ticks Up

The Mortgage Bankers Association’s latest Forbearance & Call Center Survey reported loans in forbearance increased slightly to 5.49% of servicers’ portfolio volume as of December 13 from 5.49% the prior week. MBA estimates 2.7 million homeowners are in forbearance plans.

MBA, Trade Groups Ask Federal Agencies for Clarity on CARES Act Forbearance

The Mortgage Bankers Association, the American Bankers Association and the Housing Policy Council on Thursday asked federal agencies to issue guidance establishing a consistent timeframe for CARES Act forbearance under their respective programs.

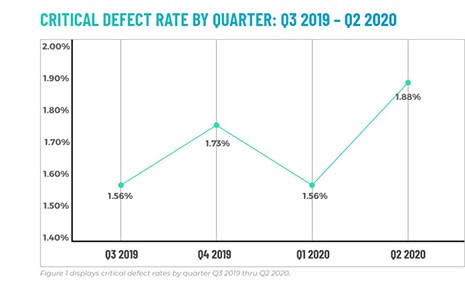

ACES: Critical Defect Rate Highest Since 2018

ACES Quality Management, Denver, said its quarterly Mortgage QC Trends Report for the second quarter reported the overall critical defect rate of 1.88% is the highest quarterly rate since 2018.

MBA: Share of Mortgage Loans in Forbearance Drops Back to 5.48%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased to 5.48% of servicers’ portfolio volume as of December 6 from 5.54% the prior week. MBA estimates 2.7 million homeowners are in forbearance plans.