With federal foreclosure moratoria slated to end June 30, the Consumer Financial Protection Bureau this week issued a report warning of widespread evictions and foreclosures, absent additional public and private action.

Tag: Coronavirus

Anita Bush: Effective Forbearance Management for Mortgage Loan Servicers

In this article, we’ll address some of the servicer’s legal requirements and offer three keys to success intended to help servicers manage the post-forbearance process.

MBA: 2021 Commercial/Multifamily Mortgage Maturity Volumes to Increase 36%

The Mortgage Bankers Association said $222.5 billion of the $2.3 trillion (10 percent) in outstanding commercial and multifamily mortgages held by non-bank lenders and investors will mature in 2021, a 36 percent increase from the $163.2 billion that matured in 2020.

Nick Volpe: Managing Effects of Changing Regulations on Mortgage Servicing Operations

As loan servicers continue to battle operational challenges and brace themselves for continuously high volume, there are strategies they should consider to better navigate the changing landscape.

MBA, Coalition Urge Homeowner Relief in COVID-19 Package

The Mortgage Bankers Association and nearly 300 other industry trade groups and community organizations urged Congress to include direct assistance to homeowners with COVID-19 hardships in any upcoming economic stimulus package.

Nick Volpe: Managing Effects of Changing Regulations on Mortgage Servicing Operations

As loan servicers continue to battle operational challenges and brace themselves for continuously high volume, there are strategies they should consider to better navigate the changing landscape.

MBA, Trade Groups Urge Homeowner Relief in COVID-19 Package

The Mortgage Bankers Association and (NUMBER HERE) other industry trade groups urged Congress to include direct assistance to homeowners with COVID-19 hardships in any upcoming economic stimulus package.

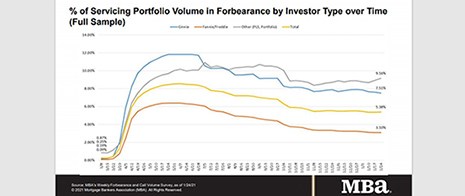

MBA: Share of Loans in Forbearance Unchanged at 5.38%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance remained unchanged at 5.38% of servicers’ portfolio volume as of January 24. MBA estimates 2.7 million homeowners are in forbearance plans.

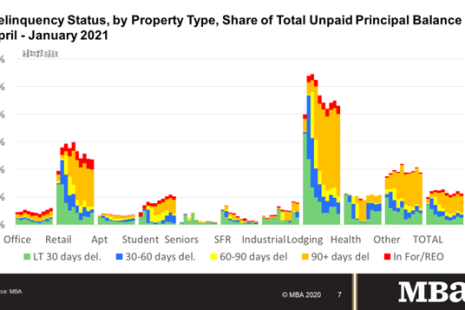

MBA: January Commercial, Multifamily Mortgage Delinquencies Decrease

Delinquency rates for mortgages backed by commercial and multifamily properties decreased in January, according to the Mortgage Bankers Association’s latest monthly MBA CREF Loan Performance Survey.

MBA: Share of Loans in Forbearance Unchanged at 5.38%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance remained unchanged at 5.38% of servicers’ portfolio volume as of January 24. MBA estimates 2.7 million homeowners are in forbearance plans.