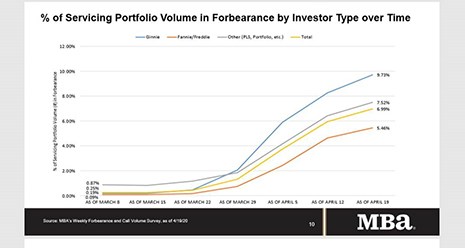

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey showed loans now in forbearance increased from 5.95% of servicers’ portfolio volume in the prior week to 6.99% as of April 19.

Tag: Coronavirus

Britt Faircloth: Fairness in the Face of Crisis–Fair and Responsible Banking in the Midst of Chaos

As a compliance officer, I have always recognized that change is constant, and I accept that fact sometimes grudgingly. While regulatory change generally has ample implementation or lead time, March 2020 has brought a different kind of change; one that is significant, sudden and jarring. These days you can’t just ask who moved your cheese—assuming you could find cheese in the grocery store, that is—you must quickly and effectively adapt to an entirely new normal.

House Democrats Add Pressure on Administration for Mortgage Servicing Liquidity

Twenty-seven House Democrats sent a letter last week to Administration officials urging them to take further steps to allow mortgage borrowers to avoid delinquency and to support mortgage servicers who are working with these borrowers.

FHFA: GSEs Will Purchase Qualified Loans in Forbearance

The Federal Housing Finance Agency said it would approve purchase of certain single-family mortgages in forbearance that meet specific eligibility criteria by Fannie Mae and Freddie Mac.

FHFA: Fannie Mae, Freddie Mac to Use 4-Month Advance Limit for Loans in Forbearance

The Federal Housing Finance Agency last week said it aligned Fannie Mae and Freddie Mac policies regarding servicer obligations to advance scheduled monthly principal and interest payments for single-family mortgage loans.

Redfin: U.S. Housing Market ‘Reverses Course’

In little more than a month, the coronavirus pandemic sent the housing market from a promising spring to a national emergency, said Redfin, Seattle.

ATTOM: March Foreclosure Report Reflects Calm Before the Storm

ATTOM Data Solutions, Irvine, Calif., released its quarterly U.S. Foreclosure Market Report, which showed 156,253 U.S. properties with a foreclosure filing during the first quarter, up 42 percent from the previous quarter but down 3 percent from a year ago.

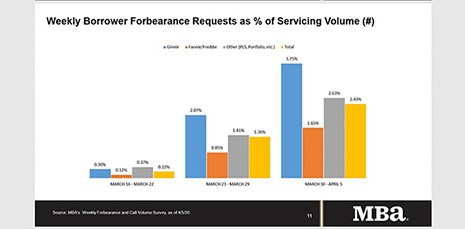

MBA Survey: Share of Mortgage Loans in Forbearance Continues to Climb

The surge in unemployment claims filed since mid-March resulting from the mitigation efforts to slow the spread of the coronavirus are straining household budgets and leading to more requests for mortgage forbearance. That is according to the Mortgage Bankers Association’s latest Forbearance and Call Volume Survey, which revealed the total number of loans in forbearance jumped from 2.73% to 3.74% during the week of March 30 to April 5.

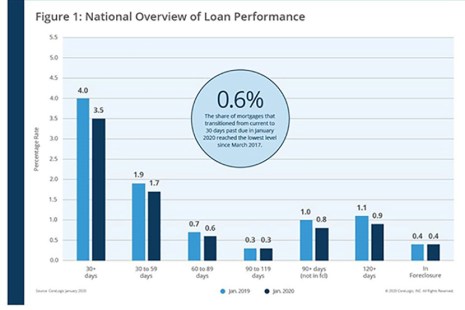

CoreLogic: Annual Delinquency Rates Fall for 25th Consecutive Month

CoreLogic, Irvine, Calif., reported 3.5% of mortgages in some stage of delinquency in January, an 0.5 percentage point decline in the overall delinquency rate from a year ago.

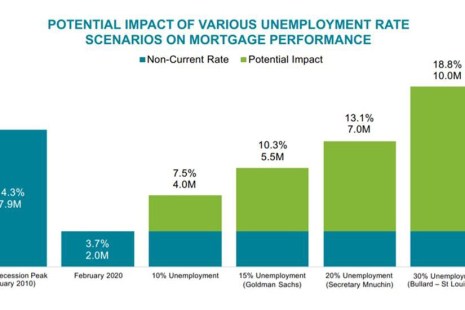

Black Knight: COVID-19 Unemployment Spike Triggering Surge in Mortgage Forbearance Requests

Leading up to the coronavirus outbreak, said Black Knight, Jacksonville, Fla., the vast majority of mortgage performance metrics were at or near record levels. Now, says Black Knight Data & Analytics President Ben Graboske, the mortgage market has been turned upside down.