What follows are findings from a survey of senior mortgage executives I conducted in the first half of May. Due to cancellation of MBA’s National Secondary Market Conference, this survey was completed over the phone rather than face to face, as has been the case in the 23 preceding surveys done since 2008. Normally the surveys are conducted at the secondary conference as well as at the MBA Annual Convention every October.

Tag: Coronavirus

(#MBA Live) Housing, Mortgage Markets Show Resiliency, Agility

With all that has hit the mortgage industry over the past several months, Mortgage Bankers Association Chief Economist Mike Fratantoni has a positive message for mortgage lenders and servicers: “It seems like the industry has done a fantastic job of finding solutions in this crazy environment,” Fratantoni said during MBA Live: Technology Solutions Conference.

Investors Prefer Debt Investment During COVID-19 Era

Real estate debt investment has become more attractive relative to equity investment during the COVID-19 pandemic, institutional investors said.

‘Zombie’ Property Stats Hold Steady Amid Foreclosure Moratorium

ATTOM Data Solutions, Irvine, Calif., said the percentage of “zombie” properties—vacant properties facing foreclosure—held steady in the second quarter as nationwide moratoria on foreclosures kept activity to a minimum.

MBA Vice Chair Kristy Fercho Testifies Before House Subcommittee on Industry’s COVID-19 Response

Mortgage Bankers Association Vice Chair Kristy Fercho testified Friday before a House subcommittee on the real estate finance industry’s response to the coronavirus pandemic, saying mortgage servicers adapted to changing customer needs quickly and asking Congress to give the industry additional flexibility to address evolving market conditions.

MBA Mortgage Action Alliance ‘Call to Action’ Urges Support of House Bill Supporting Access to Credit

The Mortgage Action Alliance, the grassroots advocacy arm of the Mortgage Bankers Association, issued a “Call to Action” urging its members to contact their House representative in support of legislation that would promote consumer access to credit during the coronavirus pandemic.

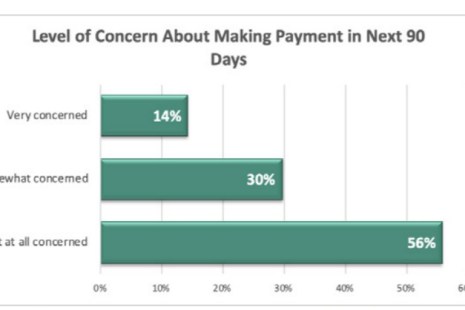

STRATMOR Study Lays Bare Uncertainties of COVID-19 Impact on Housing Market

A study by STRATMOR Group, Greenwood Village, Colo., shows just how quickly and hard-hitting the coronavirus pandemic has been on homeowners.

‘MBA Is Meeting this Crisis Head-On’

WASHINGTON, D.C.—“These are no normal times.” With those words, Mortgage Bankers Association Robert Broeksmit, CMB, not only described the past few months, but also set the tone for the future of the real estate finance industry and life in general.

MBA Outlines Industry Priorities for Next COVID-19 Relief Package

The House has its wish-list for the next round of relief stemming from the coronavirus pandemic—a $3 trillion package that has no chance of passing into law. The Senate is working on its own version—which also has no chance of passing. To help Congress out, the Mortgage Bankers Association provided House and Senate leadership with its legislative priorities for the next relief package.

Neal Doherty: A Lender’s Guide to PPP Loan Forgiveness Timeline

A key provision of the CARES ACT is the Paycheck Protection Program (PPP), which authorizes small businesses to apply for loans guaranteed by the Small Business Administration. PPP loans can be forgiven, either in whole or part, under certain conditions. This article is intended as an overview of key steps in submitting and obtaining PPP loan forgiveness.