The Mortgage Bankers Association and nearly two dozen other industry trade groups sent a letter this week to California legislators, strongly opposing as “fundamentally flawed” and “disruptive” a broad-brush bill aimed at assisting state residents experiencing financial difficulties amid the coronavirus pandemic.

Tag: Coronavirus

Zillow: Newly Unemployed Service Workers Owe $1.7 Billion/Month in Housing Payments

Zillow, Seattle, said its analysis found more than $1.7 billion in rent and mortgage payments is owed each month by U.S. service-sector workers currently receiving unemployment benefits as a result of the coronavirus pandemic — payments that could be in jeopardy if expanded local and federal unemployment assistance fades or workers remain without incomes longer than expected.

ATTOM: Home-Flipping Reaches 14-Year High in 1Q; Returns Fall to 9-Year Low

ATTOM Data Solutions, Irvine, Calif., said its first-quarter U.S. Home Flipping Report showed 53,705 single-family homes and condominiums in the United States flipped in the first quarter, the highest number since 2006.

MBA, Trade Groups Urge HUD to Modify FHA Forbearance Indemnification Policy

Sixteen industry trade organizations joined the Mortgage Bankers Association in a letter this week to HUD, expressing concerns with a recently announced FHA policy requiring lenders to provide 20 percent indemnification of the original loan amount for up to two years in relation to borrowers who enter into forbearance due to COVID19-related hardship after closing and prior to FHA insuring their loan.

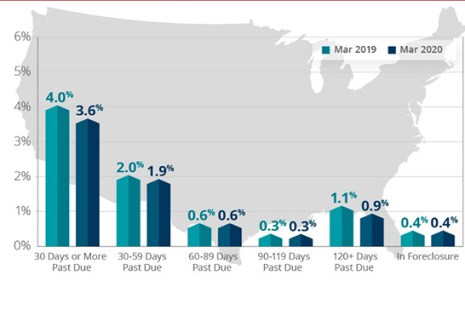

CoreLogic: Delinquencies Stay Low Despite Pandemic Impact

CoreLogic, Irvine, Calif., said its analysis of March mortgage delinquencies and foreclosures found despite the early impact of the coronavirus pandemic, delinquencies remained relatively low.

Black Knight: 1 in 10 Homeowners in Forbearance Hold 10% or Less Equity in Their Homes

Black Knight, Jacksonville, Fla., said with its analysis of borrowers in forbearance showing forbearance volumes falling for the first time since the crisis began, industry participants – especially servicers and mortgage investors – must now shift from pipeline growth to pipeline management and downstream performance of loans in forbearance.

FHA, CFPB Issue New Guidance on Forbearance

The Federal Housing Administration and the Consumer Financial Protection Bureau announced new policies to assist mortgage borrowers impacted by the economic effects of the coronavirus pandemic.

MBA: IMBs Report Strong First Quarter

Independent mortgage banks and mortgage subsidiaries of chartered banks reported a net gain of $1,600 on each loan they originated in the first quarter, up from $1,182 per loan in the fourth quarter, according to the Mortgage Bankers Association’s newly released Quarterly Mortgage Bankers Performance Report.

(#MBALive) Cybersecurity in a Remote-Work Environment

Security worries have grown as more people work remotely due to the pandemic, so it is more important than ever to consider security considerations for the teleworking environment.

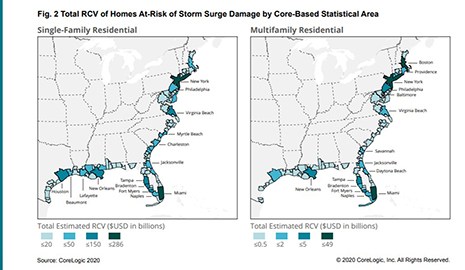

2020 Storm Surge Forecast Sees 7.4 Million Residences at Risk

Okay, just to recap: So far in 2020, we’ve had the COVID-19 pandemic; partial collapse of the U.S. economy; no spring home buying season; dam breaches in Michigan; one of the busiest tornado seasons this decade; and, God help us, “murder hornets.” Now it’s June, and the official start of North American hurricane season.