While the number of new forbearance requests is declining, many servicers may still be working with forbearance borrowers for the rest of this year and into 2021. Here’s what servicers can do to handle this new reality.

Tag: Coronavirus

May Commercial Real Estate Sales Slump

Real Capital Analytics, New York, reported commercial property sales sank again in May as the COVID-19 crisis kept investors on the sidelines.

CFPB Issues Interpretive Rule on Determining Underserved Areas; Final Rule on Loss Mitigation Options for Homeowners with COVID-Related Hardships

The Consumer Financial Protection Bureau issued an interpretive rule to provide guidance to creditors and other persons involved in the mortgage origination process about the way in which the Bureau determines which counties qualify as “underserved” for a given calendar year.

FHA Issues Temporary Waiver Suspending Early Payment Default Reviews

The Federal Housing Administration yesterday issued a temporary waiver of its Single Family Housing Policy Handbook4000.1 to temporarily suspend the requirement that mortgagees select and review all Early Payment Defaults on a monthly basis.

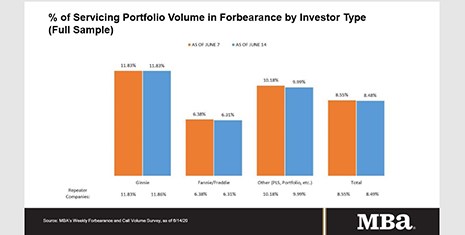

MBA: Share of Mortgage Loans in Forbearance Falls to 8.48%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey showed loans now in forbearance decreased – for the first time since the survey’s inception in March – from 8.55% of servicers’ portfolio volume in the prior week to 8.48% as of June 14.

Richard Ferguson: Preserving Down Payment Options in a Disruptive Market

There is no downplaying the destruction the COVID-19 pandemic has had on our economy and the financial lives of millions of Americans. But it is also threatening the up-and-coming generation of home buyers, particularly minorities.

Veros: Michigan Dam Disaster Cost More than $3.6 Billion

The May 20 dam breaks caused unprecedented damage and flooding in four Michigan counties. Throw in the coronavirus pandemic and you have a disaster unique in scope—and we’re only halfway through 2020.

FHFA to Re-Propose Updated Minimum Financial Eligibility Requirements for GSE Sellers/Servicers

The Federal Housing Finance Agency, citing “recent market events,” announced it will re-propose updated minimum financial eligibility requirements for Fannie Mae and Freddie Mac Seller/Servicers.

April Sees ‘Historic’ Hotel Profitability Drop

U.S. hotel profitability metrics cratered during April, reported STR, Hendersonville, Tenn. During April, the sector saw total revenue per available room fall nearly 93 percent year-over-year and gross operating profit per available room fall 116.9 percent to a $17.98 loss per room.

FHFA Extends GSE COVID-Related Loan Processing Flexibilities Through July

The Federal Housing Finance Agency extended several loan origination flexibilities currently offered by Fannie Mae and Freddie Mac designed to help borrowers during the COVID-19 national emergency through at least July 31.