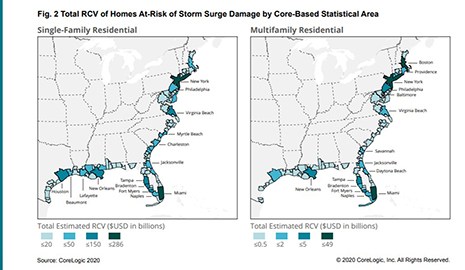

Okay, just to recap: So far in 2020, we’ve had the COVID-19 pandemic; partial collapse of the U.S. economy; no spring home buying season; dam breaches in Michigan; one of the busiest tornado seasons this decade; and, God help us, “murder hornets.” Now it’s June, and the official start of North American hurricane season.

Tag: CoreLogic

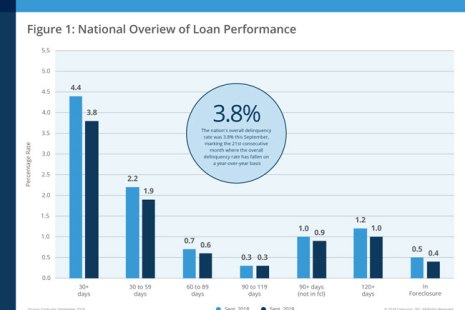

CoreLogic: Annual Delinquency Rates Fall for 25th Consecutive Month

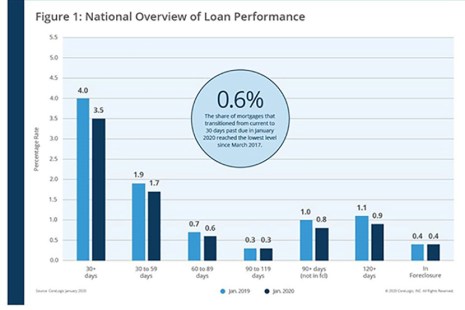

CoreLogic, Irvine, Calif., reported 3.5% of mortgages in some stage of delinquency in January, an 0.5 percentage point decline in the overall delinquency rate from a year ago.

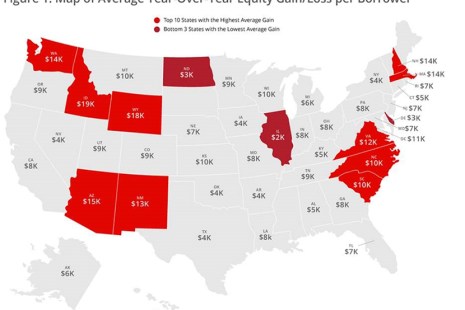

Nearly 100,000 Homeowners Regained Positive Equity in Fourth Quarter

CoreLogic, Irvine, Calif., said the number of Americans with negative equity in their homes fell to the lowest level since before the Great Recession, with 96,000 homeowners regaining equity in the fourth quarter.

CoreLogic: December U.S. Delinquency Rate Lowest in 20 Years

CoreLogic, Irvine, Calif., reported just 3.7% of mortgages in some stage of delinquency in December, the lowest for a December in more than 20 years.

Amid Rapid Change, MISMO Adapts

With mortgage technology changing in the blink of an eye, MISMO, the Mortgage Industry Standards Maintenance Organization, is changing as well.

CoreLogic: Serious Delinquency Rates Triple in Recent Disaster Areas

CoreLogic, Irvine, Calif., released its annual Natural Hazard Report, saying communities affected by wildfire, hurricanes, tornadoes, earthquakes and other natural disasters in 2019 will likely experience an increase in mortgage delinquency rates, taking 12 or more months before normalizing to pre-disaster rates.

CoreLogic: With QM GSE ‘Patch’ Set to Expire, Impact Warrants Closer Investigation

In two blog posts last week, CoreLogic, Irvine, Calif., examined the relationship between loan pricing and loan performance in context of the coming expiration of the Consumer Financial Protection Bureau’s Qualified Mortgage “GSE Patch.” The blogs noted little distinction in loan delinquencies in certain rate spread categories, but noted closer investigation is warranted.

CoreLogic: October Delinquency Rate Hits 20-Year Low

CoreLogic, Irvine, Calif., reported 3.7% of mortgages were in some stage of delinquency in October, an 0.4 percentage point decline from a year ago.

CoreLogic: 78,000 Single-Family Properties Regained Equity in 3Q

CoreLogic, Irvine, Calif., said U.S. homeowners with mortgages–representing 64% of all properties–saw their equity increase by 5.1% year over year in the third quarter, a gain of nearly $457 billion from a year ago.

Home Equity Up; Negative Equity Down

Two recent reports show equity-rich properties have increased strongly this year, while the number of properties with negative equity continue to fall.