CoreLogic, Irvine, Calif., said home prices increased 6.7% nationally in September from a year ago, the fastest annual acceleration since May 2014.

Tag: CoreLogic

CoreLogic Reports 26.3% Decrease in Mortgage Fraud Risk

CoreLogic, Irvine, Calif., reported a 26.3% year-over-year decrease in fraud risk at the end of the second quarter, the second year of substantial decreases in risk.

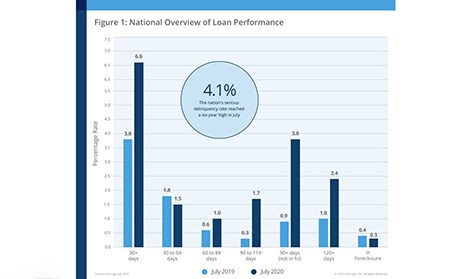

CoreLogic: Serious Delinquencies Spiking Despite Strong Housing Demand

CoreLogic, Irvine, Calif., reported an increase in overall mortgage delinquency rates in July—and in particular, a spike in serious delinquencies to their highest level in more than six years.

CoreLogic: Nearly 2 Million Homes at Elevated Risk of Wildfire Damage

CoreLogic, Irvine, Calif., released its 2020 Wildfire Risk Report as smoky skies and poor air quality continue to burden cities up and down the West Coast.

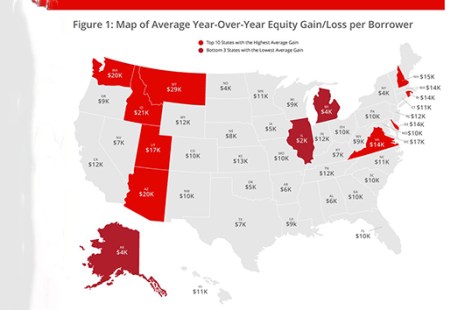

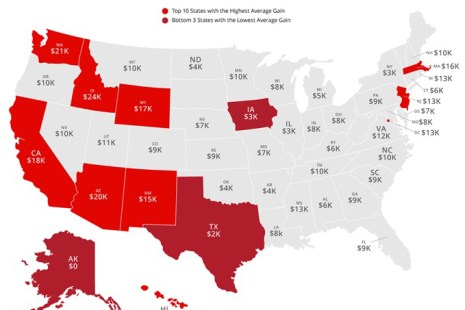

CoreLogic: Despite Pandemic, Homeowners Gain $620 Billion in Equity

CoreLogic, Irvine, Calif., said its 2nd Quarter Home Equity Report shows U.S. homeowners with mortgages—which account for 63% of all properties—have seen their equity increase by 6.6% year over year. This represents a collective equity gain of $620 billion and an average gain of $9,800 per homeowner from a year ago.

ATTOM: Foreclosure Filings Continue Downward Trend Amid Pandemic

This week, the Mortgage Bankers Association releases its 2nd Quarter National Delinquency Survey. Last week, ATTOM Data Solutions, Irvine, Calif., said foreclosure moratoria stemming from the coronavirus pandemic kept new foreclosure filings low—but warned they could increase dramatically once those moratoria expire.

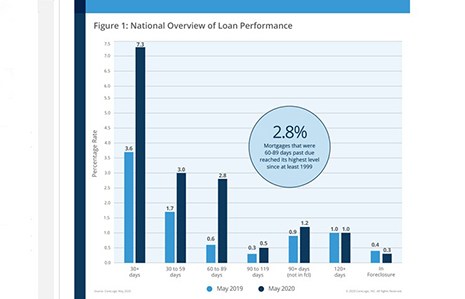

CoreLogic: ‘Clouds on The Horizon’ for Many U.S. Homeowners as Delinquency Rates Climb

Ahead of this week’s 2nd Quarter National Delinquency Survey from the Mortgage Bankers Association, CoreLogic, Irvine, Calif., said early-stage and adverse mortgage delinquency rates increased for the second consecutive month, with all 50 states and more than 75% of U.S. metro areas seeing increases in overall delinquency rates.

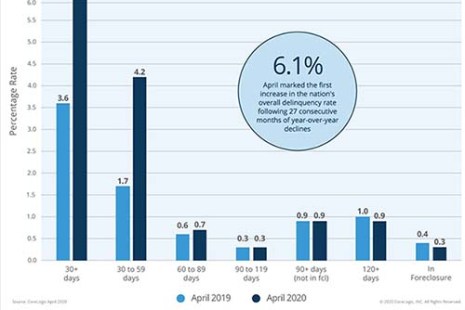

CoreLogic: Mortgage Delinquencies Hit Downslope

CoreLogic, Irvine, Calif., said April early stage mortgage delinquencies jumped to levels that exceeded even those during the Great Recession.

CoreLogic: Borrowers Gain $6 Trillion in Home Equity Since End of Great Recession

CoreLogic, Irvine, Calif., said U.S. homeowners with mortgages—representing 63% of all properties—have seen their equity increase by 6.5% year over year, representing a gain of $590 billion since 2019.

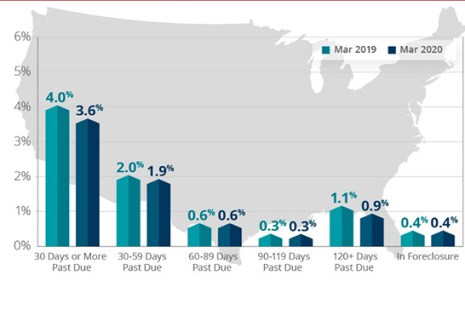

CoreLogic: Delinquencies Stay Low Despite Pandemic Impact

CoreLogic, Irvine, Calif., said its analysis of March mortgage delinquencies and foreclosures found despite the early impact of the coronavirus pandemic, delinquencies remained relatively low.