CoreLogic, Irvine, Calif., released its Homeowner Equity Report for the fourth quarter of 2024, finding that nationwide, borrower equity increased by $281.9 billion. That’s an increase of 1.7% year-over-year.

Tag: CoreLogic Homeowner Equity Report

CoreLogic Homeowner Equity Report Shows Positive Gains From Q1 to Q2

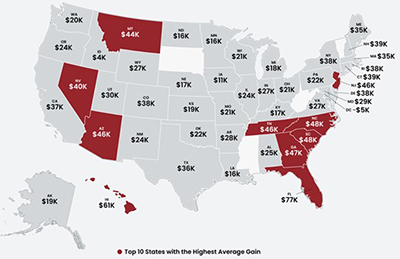

CoreLogic, Irvine, Calif., released its Homeowner Equity Report for the second quarter. While U.S. homeowners with mortgages saw home equity decrease 1.7% year-over-year, they also saw gains from the previous quarter–an average of $13,900.

CoreLogic: 4Q Home Equity Gains Slow Further

CoreLogic, Irvine, Calif., said homeowners with mortgages (which account for roughly 63% of all properties) saw equity slow to a 7.3% increase year over year, representing a collective gain of $1 trillion, for an average of $14,300 per borrower, from one year ago.

CoreLogic: Home Equity Gains Down Sharply From Second Quarter

CoreLogic, Irvine, Calif., reported homeowners posted average annual equity gains of $34,300 in the third quarter—half the year-over-year increase recorded in the second quarter.

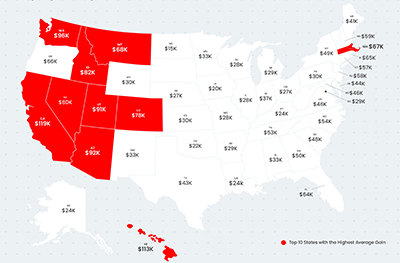

CoreLogic: Homeowners Gained $3.2 Trillion in Equity in Q3

CoreLogic, Irvine, Calif., said homeowners with mortgages (which account for 63% of all properties) saw their equity increase by 31.1% year over year in the third quarter, representing a collective equity gain of more $3.2 trillion and an average gain of $56,700 per borrower.