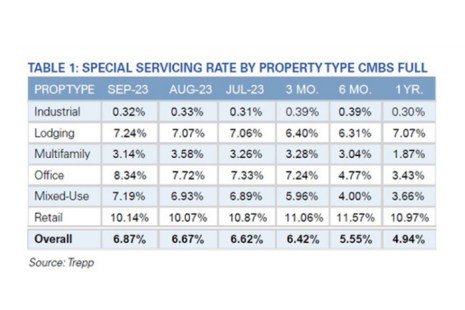

Trepp, New York, reported the CMBS Special Servicing Rate increased by 20 basis points in September, up to 6.87%.

Tag: CMBS

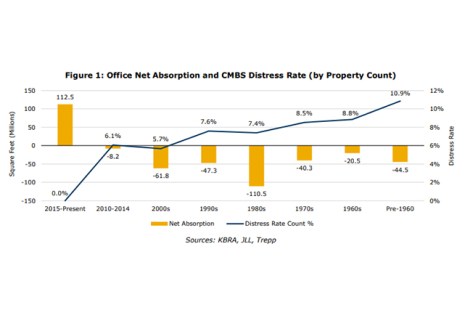

KBRA: Older Office Buildings Struggling

KBRA, New York, said in the current office environment, older buildings are seeing particular challenges.

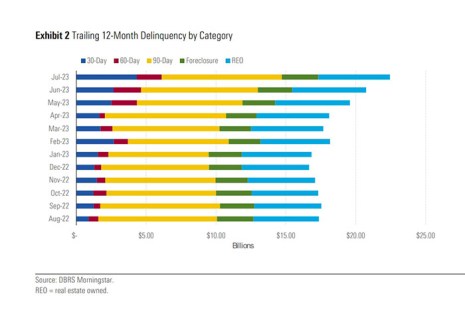

DBRS Morningstar: CMBS Delinquency Rate Surges

DBRS Morningstar, Toronto, reported the delinquency rate for loans packaged in commercial mortgage-backed securities surged 31 basis points in July. The special servicing rate rose for the fifth straight month, increasing 24 basis points during July.

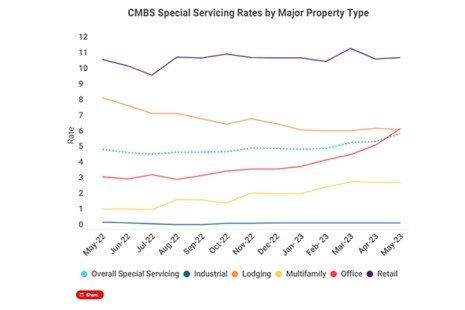

Trepp: CMBS Special Servicing Rate Rises to 6.11%

Trepp, New York, reported its CMBS Special Servicing Rate climbed 49 basis points to 6.11% in May, marking its fourth sequential monthly increase.

Commercial Real Estate Reset? A Special Servicing Roundtable

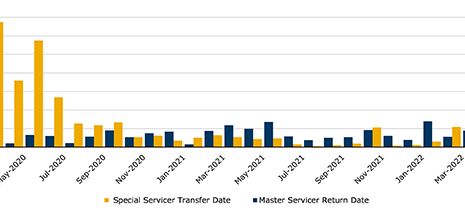

As property sale transactions and originations stall, MBA NewsLink interviewed two special servicing executives and a CMBS researcher to get their insights on the commercial real estate finance landscape and outlook.

KBRA: Servicers Performed Admirably During COVID

Kroll Bond Rating Agency, New York, said commercial mortgage-backed security servicers “performed admirably” over the last two years while facing nearly unprecedented distress during the COVID pandemic.

Andrew Foster: Case-By-Case–Commercial Mortgage Forbearance Consideration Begins

While the hope remains that the recession will be short-lived with a strong recovery in the second half of 2020, commercial real estate typically lags the broader economy. Any quick relief for the commercial mortgage industry will be due in part to government relief efforts. It will take patience from market participants before a clear picture of various outcomes emerges, in part because so much of the CRE finance market impacted by COVID-19 is entering into forbearance agreements.

The CMBS Market During a Pandemic: A Fitch Ratings Q&A

MBA NewsLink interviewed Fitch Ratings Senior Director of Structured Finance Adam Fox and Senior Director Britt Johnson about the potential impact of the COVID-19 pandemic on the commercial mortgage-backed securities market.